oltciter

-

Număr mesaje

2.297 -

Înregistrat

-

Ultima Vizită

-

Zile Câștigate

146

Tip conținut

Profiluri

Forumuri

Bloguri

Postări postat de oltciter

-

-

-

-

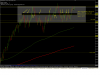

De unde este platforma aceea? Vad ca apar gapuri pe ea, sa inteleg ca este platforma de futures direct, nu de CFD-uri?

Este platforma profesionala a celor de la ThinkOrSwim (TOS). Au toata gama de produse (stokuri, optiuni, futures, forex). Cont minim de deschidere pentru forex 3500 $, pentru stokuri (full option) 25.000$. Se pot tranzactiona peste 4000 de produse.In una din analizele precedente (daca nu ma insel in ce saptamnala de pe 20 feb )am facut la sfarsitul analizei o scurta prezentare a platformei.

Validare contului dureaza cam 30 de zile. Trebuiesc semnate actele in original si trimise prin posta !

-

-

Analiza tehnica weekly daily 20feb2011.Recomand vizionare in fullscreen!

-

Analiza tehnica weekly daily 12feb2011.Recomand vizionare in fullscreen!

-

1

1

-

-

-

2

2

-

-

-

-

1

1

-

-

-

-

3

3

-

-

-

4

4

-

-

Analiza tehnica weekly daily 05feb2011. Recomand vizionare fullscreen!

Later edit: Am sters inregistrarea! Imi cer scuze pentru defectiunea tehnica aparuta. Pe inregistrarea din calculatorul meu totul era OK, dar se pare ca pe conversia celor de la Ustream nu a mai fost ok! Am sa revin maine cu analiza refacuta! Sper sa nu mai fie probleme!

-

1

1

-

1

1

-

-

-

-

1

1

-

-

Analiza tehnica monthly daily 01feb2011. Recomand vizionare fullscreen!

-

-

1

1

-

-

-

3

3

-

-

-

2

2

-

-

Iata o atentionare interesanta!

One good part of the new CFTC regulations from last year is that the CFTC has some amazing new enforcement powers. I just got a note from a good friend of the FPA about the CFTC suing 14 forex brokers.

Many of these brokers are very well known to the FPA. Some are on good terms with the FPA. Some aren't. All are invited to post public responses here about their point of view.

Here's the press release....

RELEASE: PR5974-11

January 26, 2011

CFTC SUES 14 FOREIGN CURRENCY FIRMS IN NATIONWIDE SWEEP

Action represents first use of new authority under the 2008 Farm Bill and Dodd-Frank Act to regulate foreign exchange dealers.

Washington, DC - The U.S. Commodity Futures Trading Commission (CFTC) today announced that it simultaneously filed 13 enforcement actions in Federal District Courts in Chicago, the District of Columbia, Kansas City and New York, alleging that 14 entities are illegally soliciting members of the public to engage in foreign currency (forex) transactions and that they are operating without being registered with the CFTC.

Today’s actions are the first taken by the CFTC to enforce new forex regulations that became effective in October 2010. These new regulations require entities that wish to participate in the forex market to register with the CFTC and abide by regulations intended to protect the public. These regulations require that forex dealers take steps to protect investors, including maintaining capital and records, which will reduce risk and increase transparency.

The following companies were sued by the CFTC as part of this sweep:

EuroForex Development LLC, a Delaware LLC;

FIG Solutions Limited, Inc., a Delaware corporation;

ForInvest, a Delaware corporation;

FXOpen Investments Inc., a Delaware LLC;

FXPRICE, a Delaware LLC;

GIGFX, L.L.C., a Delaware company;

InovaTrade, Inc., a company with purported offices in Florida;

InstaTrade Corporation d/b/a InstaForex, a British Virgin Islands company;

InvesttechFX Technologies, Inc., a Canadian corporation located in Toronto;

J&K Futures, Inc., a company with purported offices in California and New York;

Kingdom Forex Trading and Futures, Ltd., a Nevada company;

Prime Forex, LLC, a Delaware LLC;

Wall Street Brokers, LLC, a Delaware LLC; and

ZtradeFX LLC, a Connecticut LLC.

In the forex market, entities known as Retail Foreign Exchange Dealers (RFED) or Futures Commission Merchants (FCM) may buy foreign currency contracts from or sell foreign currency contracts to individual investors. Under the Commodity Exchange Act (CEA) and CFTC Regulations, an entity acting as an RFED or FCM must register with the Commission and abide by rules and regulations designed for investor protection, including those relating to minimum capital requirements, recordkeeping and compliance. Further, with a few exceptions, such an entity also must be registered with the Commission if it solicits or accepts orders from US investors in connection with forex transactions conducted at an RFED or FCM.

In all but two of the complaints, the CFTC alleges that a defendant acted as an RFED; that is, it offered to take or took the opposite side of a customer’s forex transaction without being registered. In the remaining two complaints, ZtradeFX LLC and FXPRICE, the CFTC alleges that the defendant solicited customers to place forex trades at an RFED without being registered as an Introducing Broker. In every complaint, the CFTC alleges that the defendant solicited or accepted orders from US investors to enter into forex transactions in violation of the Act. The CFTC has moved for preliminary injunctions preventing these defendants from operating unless and until they comply with the CEA and Commission Regulations. The CFTC’s complaints also seek civil monetary penalties, trading and registration bans, disgorgement and rescission.

The CFTC strongly urges the public to check whether a company is registered before investing funds. If a company is not registered, an investor should be wary of providing funds to that company.

A company’s registration status can be found at: BASIC Search

The CFTC also strongly urges members of the public to visit the below websites before investing money in the forex market:

CFTC Consumer Advisory: Forex Fraud: If it sounds too good to be true, it probably is!

CFTC Consumer Advisory: Foreign Currency "Forex" Fraud

Fraud Advisory from the CFTC: Foreign Currency Trading (Forex) Fraud

Foreign Exchange Currency Fraud: CFTC/NASAA Investor Alert

Foreign Currency Trading - CFTC

The CFTC Division of Enforcement staff members responsible for these cases are: Margaret Aisenbrey, Kathleen Banar, Barry Blankfield, Kim Bruno, Jennifer Chapin, Elizabeth Davis, James Deacon, Jennifer Diamantis, Rick Glaser, Patricia Gomersall, Amanda Harding, Jessica Harris, Paul Hayeck, Lenel Hickson, Rosemary Hollinger, William Janulis, Joseph Konizeski, Jeffrey Le Riche, Charles Marvine, Judith McCorkle, Joy McCormack, Vincent McGonagle, Kenneth McCracken, Stephen Obie, Nathan Ploener, Eliud Ramirez, Stephanie Reinhart, Xavier Romeu-Matta, Christine Ryall, Veronica Spicer, Elizabeth Streit, Manal Sultan, Lara Turcik, Stephen Turley, Richard Wagner and Scott Williamson.

The CFTC thanks the National Futures Association for its assistance in this matter.

Last Updated: January 26, 2011

Media Contacts

Dennis Holden

202-418-5088

Office of Public Affairs

The original is at www.cftc.gov/PressRoom/PressReleases/pr5974-11.html

-

1

1

-

-

-

2

2

-

-

@tradelover

OfftopicHi hi! Am zis 22 decembrie?!! Super! Tinand cont ca ma scol la 4:45 AM ca sa fac inregistrarea analizei tehnice , nici nu este de mirare. Cafeaua o servesc abia pe la 06:30 AM. Multumesc mult maestre ca mi-ai atras atentia.Cum trezirea la mine se face pe parti, am sa comand desteptarea neuronului la inceput, si abia pe urma o sa urmeze un picior, o mana .... si la sfarsit.....urechea dreapta! Nu te gandi la prostii ca ma rusinez! Bafta!

Bafta!Later edit: De fapt filmul la care te referi a fost facut sambata dimineata mai tarziu! Dar se pare ca sambata al meu neuron e plecat putin in weekend!

-

-

2

2

-

-

@eagles27

Ma bucur sa aud vesti despre tine. E placut sa reintalnesti colegi vechi!

Later edit: mecanica auto era un hobby , nu meseria mea!

Clipuri forex

în Strategii si planuri de tranzactionare

Postat

Analiza tehnica daily 25feb2011.Recomand vizionare in fullscreen!

http://blip.tv/play/hu8QgqbhGwA