sogard

Traders-

Număr mesaje

26 -

Înregistrat

-

Ultima Vizită

-

Zile Câștigate

2

Tip conținut

Profiluri

Forumuri

Bloguri

Orice postat de sogard

-

Nu urmaresc piata de capital de la noi, insa pare un pariu cu sanse slabe

-

In ultima perioada a cumparat topuri si a vandut bottomuri.

-

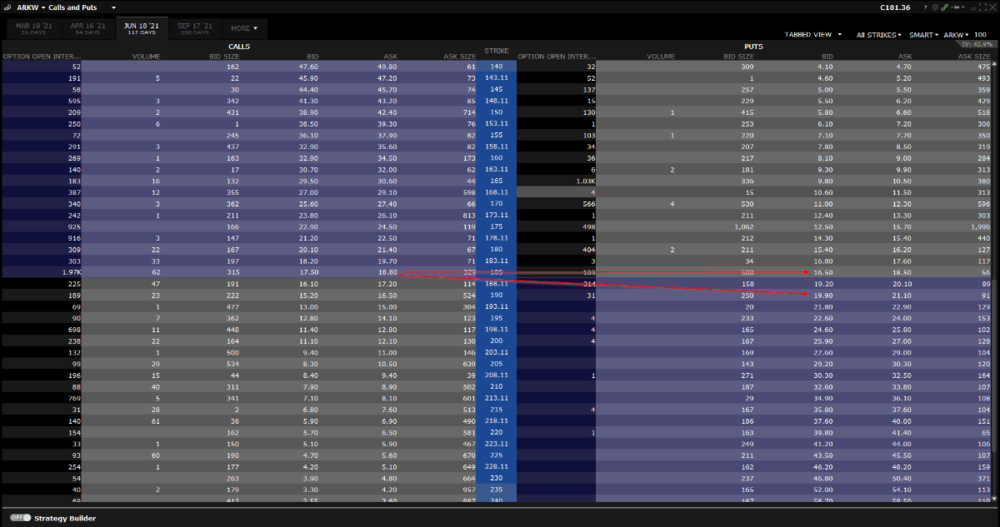

de vina este o legislatie europeana, PRIIPS. mai multe detalii aici: https://www.justetf.com/ch/news/etf/us-domiciled-etfs.html optiunile sunt insa disponibile. poti cumpara un call cu strike = pret curent si vinde un put = pret curent, ambele cu maturiate cat vrei sa tii ETF-ul. practic iti creezi o pozitie sintetica din optiuni Later edit: m-am jucat putin in IB strategy builder varianta 1: synthetic 185 - cumperi un call cu strike 185, maturitate 18 iunie 2021, la 18.80 - vinzi un put cu strike 185, maturitate 18 iunie 2021, la 16.50 te costa 2.3 USD sa intri in aceasta strategie care replica performanta ARKW. Faci bani daca la maturitate pretul e peste 185 + 2.3 = 187.3. Pierderea ramane la pretul platit initial pentru intrarea in strategie daca arkw e intre 185 si 187.3. De la 185, incepi sa pierzi bani pe langa pretul platit initial Varianta 2: risk reversal (practic tot un fel de pozitie sintetica insa esti platit sa intri in strategie deoarece vinzi un put cu strike mai mare decat strike-ul call-ului) - cumperi un call cu strike 185, maturitate 18 iunie 2021, la 18.80 - vinzi un put cu strike 190, maturitate 18 iunie 2021, la 19.90 Primesti 1.10 USD pentru intrarea in aceasta strategie. Daca la maturitate pretul e peste 190, incepi sa faci bani. Daca e intre 185 si 190, ramai cu cei 110 USD. Incepand cu 185, pierzi bani Sper sa te ajute.

-

Ce ati vrea sa gasiti pe un site/forum de forex in romana?

sogard a răspuns la subiect lui Fata Morgana în Oameni si comunitate

Gogu, asa cum cererea mea este iesita din tipar probabil asa sunt si asteptarile mele. O sa aud lucrurile insirate de tine daca o sa le pun interbari despre sistemul lor, despre ce indicatori folosesc, ce timefreme, insa nu asta ma intereseaza pe mine. Sunt interesat de alte aspecte, mai putin tehnice, de genul ce ocupatie au avut inainte sa se apuce de trading, cum imbina ocupatia actuala cu tradingul, cum au esuat si cum au construit iar pas cu pas, ce i-a determiant sa nu abandoneze, cate ore dedica studiului, ce materiale folosesc in studiul lor, cum au inceput si ce i-a determinat sa urmeze aceasta cale, chestii de genul asta. Cate seminarii au loc zilnic nu stiu, cu atat mai putin daca scade procentul celor care pierd. Stiu sigur un singur lucru, forexul este si o afacere si cu certitudine cresc conturile celor care tin seminariile respective. Ca in orice afacere exista oameni informati si oameni mai putin informati -

Ce ati vrea sa gasiti pe un site/forum de forex in romana?

sogard a răspuns la subiect lui Fata Morgana în Oameni si comunitate

Eu as vrea sesiuni Q&A cu oamenii citati in threadul "Romani de succes in forex", cu veteranii de la noi (nu trebuie sa dau nume, pot fi gasiti pe aici, pe Eurist sau pe AGF). As vrea ca acestia sa fie respectati, numai asa ii putem face sa ne impartaseasca din experienta lor si numai asa poate creste valoarea forumului. Si as mai vrea sa se organizeze intalniri lunare, daca nu macar trimestriale intre membrii forumului. Acestea sunt dorintele mele, va multumesc mult. -

Salut, nu am vazut ca s-a postat in acest thread deoarece e in josul paginii si n-am ajuns pana acolo Cartile au fost sterse de cei de la filefront datorita incalcarii politicii de copyright. Nu ma dau batut insa, ma gandesc sa facem un thread separat, numit "Biblioteca forex" sau ceva de genul, unde lumea sa solicite carti iar cei ce le detin sa le uplodeze pe rapidshare.de. Aici nu sunt sigur probleme iar linkurile tin destul de mult

-

Expert: Liviu Flesar, Founder and Senior Forex Advisor, E-Forex.ro Topics: - Using the mid-term analysis for intraday trading - Filtering the false signals and identifying the good entry levels - Identifying the exit opportunities - Playing the breakouts Who is Liviu Flesar? Liviu is known by many active and novice traders worldwide since he started offering the trading advisory services like the daily trading recommendations and the weekly outlook. He started the website E-Forex.ro in 2004, he is specialized in trading currencies, technical anlysis, trading systems development but is also a daily contributor of fxstreet.com. Session Transcript: ____________________________________________________________________ Special message from FXCM: As the leader in FX research for Prop FX traders, FXstreet.com invites experienced and renowned FX industry professionals, traders, and leaders to speak to prop traders like yourself about market trends and how to be a more successful trader. This information has proven extremely valuable to FXstreet's readers/clients as many feel they learn more through these Webinars open discussions than in expensive FX courses. So for a limited time – promotion ends April 30th 2005 - FXCM is offering traders free access to FXstreet's Live Q&A transcripts for opening an account today with FXCM. _______________________________________________________________________ Efficient techniques for the intraday trading My name is Liviu Flesar, I started trading currencies for fun a few years ago and someday I realized that this is a little more than gambling, so I've made the first important step toward the serious trading, starting studying and applying the Technical Analysis in order to get some clues about the high probability entry and exit levels which will bring better trades, therefore, larger profits. The funniest thing when using many technical analysis tools and complex strategies was that I found out the “ironical element” telling me something like "Man! This mess on the charts made of 5 indicators and 4 oscillators gives me much more losses than the coin toss strategy I was using in my first week of trading!" . In fact, the coin flipping strategy was more profitable than a basic MA Crossover system. The essential thing is that a trading system has to be as simple as possible. I guess that every complicated problem has a very simple solution, so, why using complicated formulas in the circumstances where a simple trend line is efficient ? Using the medium term analysis for day trading Depending on people beliefs, the reasons for losing money in trading are structured on two elements: a) several reasons, probably 1 million reasons why traders fail and B) a single reason: the market's fault. Personally, I think that only the first element is true and we have to accept that we are the only ones to blame when taking the trades in the wrong direction. Someone said that „In trading, you have only one enemy: yourself „ . Makes sense ? So, one of that 1 million mistakes day traders do is the ignorance of the larger time frames. Like for example, a day trader uses only the 15 min charts ignoring the larger time frame charts like 4 hours, 8 hours daily and so on. This is definitely wrong unless that trader is a convinced scalper who gets out from any trade at 3 or 5 pips profit. We want more than 3 pips, isn't it ? Or we want that ridiculous 3 pips gains but trading 100 standard lots ? I like using the 4H hrs. charts in order to have a better view of the previous few days. The first step is identifying the support and resistance levels on that time frame of about 5 days and drawing the fibonacci retracement levels. If possible, I also add one or few trend lines which will serve along with the support and resistance levels. After these steps are made, I can easily change the chart time frame because the lines will be there on the new intraday chart too. Why doing all this ? Because it is good to know what is the importance of some chart area in the next few hours. For example, I chose most of my entry levels at the 50 and 38.2 Fibonacci retracement levels. Depending on my position type, these two levels may also serve as exit levels. The weekly support and resistance levels are also very important. I am sure that most of you noticed how market reverses right after entering a trade but looking at the 4H charts a bit later, that reverse looks normal. This happens all the time and the mistake is caused by the hurry, which is an opposite of discipline in trading. It is better to think twice before entering a trade when the price is near the weekly resistance and support levels. Other important facts when trading using small time frames charts, are the indicators and oscillators like moving averages, Stochastics, MACD and so on. I recommend taking a look at a larger time frame chart indicators and oscillators before taking a decision using the smaller time frame charts. The larger time frame charts are very useful when used for confirmations. When looking at larger time frame charts, you can easily notice what's the current market trend and avoid entering a trade in the opposite direction, even if the small time frame technical studies point to a potential minor trend. Filtering the false signals and identifying the good entry levels This topic is related to the trading systems based on technical indicators. I am sure everyone used or heard about MA crossover, MACD or Stochastic systems. All these three systems are fine and they are working great but only when the market moves on a trend. Unfortunately, 70-80% of the time, the markets are consolidating and retracing and because of the specific lag of these tools, we will get into a trade too late, when the market will be exhausted and preparing to turn around against us. I remember how happy I was when I applied for the first time two Exponential Moving Averages, one period 5 and second period 20 on the USD/JPY 1H chart. I thought I discovered the holy grail. The crossing signals were so accurate at the first sight on the historical chart that I told myself "you're gonna become a millionaire soon!" . That happened on a Saturday afternoon, so I wasn't able to forward test that strategy until the market open, next day. I was almost unable to sleep because I was thinking about the 2000 pips profit I'll get during the next week. Instead of 2000 pips profit I got only my Stop Loss hit for 12 times and 2 winning trades. I was so disapointed but I continued in the next two weeks with different periods for the MA, different chart time frames and the results were almost the same. The 300 pips profit I've got trading an EMA crossover signal on the 4H charts was nothing more but that thing telling me: "this strategy works only on trending markets and if I really want to continue using it, I have to find some tools to filter out the false signals". So, when being a day trader, you will probably need something better than MA crosses, something that will be less lagging. I use the Moving Averages only for trend confirmations now and sometimes I forget to add them on the charts and I don't even notice that. Moving Averages also work pretty fine as support/resistance levels, when price gets above or below them. Most of the times, I use a setup of 3 elements for the entry confirmations: 1. Williams %R oscillator gives me confirmations for long positions when it closes above -35 and for the short positions when it closes below -65. 2. Moving Averages, especially T3 or T6 MA. Long positions are confirmed when price closes above MA and short positions are confirmed when price closes below MA. I also like to use the MA levels as entries like for example: EUR/USD 1H bar closes 30 pips above 12 period MA, I look for a long position at the 12 period MA value, which will be about 30 pips below the current price. 3. Daily support and resistance levels along with the Fibonacci Studies and momentum based indicators. The Fibonacci studies are what I use for, let's say, 90% of my trades. Along with the technical analysis tools, there are several other factors that will help us decide when to trade and when to ignore the signals of our mechanical trading systems. The time of day is very important because every trading session has its own characteristics. There is also a frame of a few hours when the market takes its daily breath. Because of these quiet hours, most systems will give false signals during the non-volatile hours (e.g.: before the Asian session open). Therefore, it is better to ignore the mechanical signals during the quiet hours. Another important thing is the discretion. Most of the times, a trading system works fine only for the one who designed it. That's why the "one million traders, one million systems" sentence exists. I've met some traders that were successful without using technical or fundamental analysis. They were trusting only their opinions when looking at the charts, like the charts were saying "hey! I sit on a high area, I will consolidate during the Asian session and drop below yesterday low during the European session". I believed their success is nothing more than luck but I was wrong, because luck doesn't come back every day, for three consecutive weeks, isn't it ? Without discretion, we won't be able to be successful. Even the best mechanical trading system have the chances to fail on the long run, not being so profitable in the future. I know that some people use automated trading systems with success. Personally, I wasn't able to follow a mechanical system without emotions and own opinions. Trading is a psychological game and we all know that. Where will be the fun, the happiness and even the worst feelings like frustration and greed if we will let a machine trade for us? That's not trading. It is the same like having your own teleporting device, it will be very useful when you will be in a hurry to get at the workplace but if you like driving, and you love your sport car, you will definitely prefer to use your car not the teleporting device because the simple action of pushing a button doesn't compare to your own pleasure which is driving. We have to learn the fact that understanding ourselves is the only potential key to profitable strategies. A total approach for understanding the market requires both strategies and tactics that will help us understand ourselves and of course, understand the markets as well. Identifying the exit opportunities When to exit a trade? - that's a question we all ask ourselves. In fact, the exit level is more important than the entry level. We can enter a trade whenever we want, the entry it's one mouse click away from us. We don't even have to take a look at the charts or at any economic calendar before entering a trade. We can even flip a coin and decide if we will go long or short. Isn't that easy ? We have 50%-50% chances of having a winning trade. So, if the chances are 50-50, why 95% of the traders out there are losing money ? Happens to anyone to have 50 pips profit on a running position, waiting for more because all the indicators are confirming that position but the market reverses suddenly and the 50 pips are gone exiting at breakeven or even less, how about 100 pips less because there was a Non Farm Payrolls report ? That's really frustrating. Why not exiting that position at 50 pips profit ? Well, the exit level is the hardest thing to chose. Every entry level has to be decided along with both target and stop loss levels. Without this “set of 3”, we will probably fail. Let's apply the "no target" mistake to real life. I take my clothes, my shoes and my wallet, I close the door and I get out from home, downstairs in the street. I know that I wanted to get out from home, but going where? Without a predefined localtion I'll stay there looking at the people rambling on the streets telling myself "Now what?!" and probably getting back home asking myself "where I wanted to go ?!" for several times all the way upstairs. All I needed was a plan. Like, getting out to buy myself a beer from the corner shop. So, I get out from home, get to that shop and get back with the beer. This is discipline. And of course beer is part of discipline because it helps making rational decisions until there's not too much of it. We need a trading plan. We have to ask ourselves "what's the target of this trade?" and "Where do I stop if I am wrong?" before entering any trade. So we set up the limit and S/L orders. But where ? This depends on so many things. Some traders are looking for a strict predefined target on every trade they take. Doing so, it is easier. Like for example, being satisfied with 30 pips per trade which is a great target on the long run if we are able to achieve it constantly. But what about the stops ? Well, using a fixed 30 pips target with a 90 pips stop loss won't be a good idea. The stop loss level has to be at least equal to the target level. Equal target and stop loss are ok as long as the system we use is profitable enough to have more than a 1:1 ratio of winning/losing trades. A good strategy is using a trailing stop, even automatic or manually triggered. Locking profits and liquidating portions of our positions is a recommended thing to do. But what about the first target level we have to set when entering a trade ? Personally, when day trading, I set an initial 70 pips target or I set an initial target based on the important zones of the chart like support/resistance, retracements. I lock profits or add more to the position until I decide to exit the trade. For example: I move the stop at breakeven when I have 30 pips on my side, adjust that at 20 pips when there are 50 pips profit and so on. But I exit the trade when I think there will be a retracement, reversal or some major event. For confirmations of my position I analyse the larger time frame charts because they are essential, as noticed on our first topic. It is very important to adjust the stop loss order when the market is about to test some support/resistance level. Most of the times, the market is reversing after 2 or 3 failed tests of the support and resistance levels. Therefore, I use a tight stop when the market is testing the sup/res levels. Usually, the markets are testing both daily support and resistance levels during the day. It is also a good idea to draw the support and resistance levels on the charts, and when you decide to enter a trade, put the initial stop a few pips below or above the support/resistance levels. It is safer. Playing the breakouts I will start this topic with a continuation of the previous topic. Support and resistance levels are very useful as entry levels. Sometimes the market is reversing when testing a support/resistance level and sometimes it steps forward breaking these levels. But when is a resistance/support level breached ? Here is where some people got it wrong. A support/resistance level is breached only when price closes above/below it. Almost every day we see sup/res tests when the market spikes through that levels and unfortunately some traders enter trades in the direction of the spikes because they think the sup/res levels were not strong enough to hold the tests and got breached. That's wrong. Double/triple bottoms and tops are also very useful when deciding to enter a position after the support/resistance tests. The double/triple bottom is a reversal pattern made up of two/three equal lows followed by a breakout above the resistance level. The double/triple bottom is not complete until a resistance breakout. The highest point of the formation, which would be the highest of the intermittent highs, marks resistance the major resistance. The same applies on double/triple tops but in this case we will look for a support breakout instead resistance. The support and resistance breakouts are good entry levels for reversal trades. Let's take the first picture as an example. We have a support level at 1.3587 and a resistance at 1.3655. A doubled top was formed after two resistance tests. Notice that the market got above the resistance by a few points. Even so, it was not a complete breakout because the bar didn't close above. A bit later, it is time for the support level to be tested. It also got breached, therefore a good short entry level will be around the bar close, in the 1.355 area or even higher, near the 1.3487 level which is now a resistance. In both entry cases, it is a good trade for an objective of 100 points or more. But how about taking another trade, entering short in the 1.353 area where we see the 50% retracement of the previous large fall ? That's another good trade. You should all know that the market is retracing a lot during it's long-term moves and that's why fibs are working fine as entry/target levels. If you didn't used the Fibonacci levels too much in the past, please try looking in the past on the hourly charts how great the 50% fibonacci retracement works as an entry. Apply the fibonacci studies from some daily lows to daily highs (or opposite) and you will notice that for many times, the market will reach the 50% retracement during the next day and reverse there, becoming a potential good trade. This is only one of 1 million ways that demonstrates the efficiency of the most simple things we can use in our favour. I've prefered to take a “fresh” day for the second picture example. This happened on Tuesday 26 of April, two days ago. We apply the retracement study on the previous large move, more or less, being the Monday's high to low (A to B). The entry level will be the X area, 50% retracement of the AB move. But what about the target ? Well, when using this strategy I prefer to target the A or B level, depending on my position. In this case, we talk about a short position, so the objective will be the B' level, seen at 1.2955. That's what I call an accurate trade, entering short at the daily high level and exiting at the daily low. Couldn't be better than that in a single day, isn't it ? I'll be glad if you will try to find the same patterns on the charts. Works best on Eur/Usd but on other pairs as well. The last two pictures are other examples of how great Fibonacci Studies work. Pentru a vedea pozele click aici Sursa: www.fxstreet.com

-

Cartea despre care vorbea Fata Morgana o gasiti aici

-

Am mai gasit cateva articole de acelasi autor Date: November 26, 2004 15:00 GMT-10 AM EST Expert: Mihai Nichisoiu, Chief Trader of Forex Grand Capitals Topics: - Simple candlesticks and bars price patterns: outperforming trading setups - Specific trading setups during the current year: short-term vs swing trading - Risk management: still the biggest part of the trading equation - What would you consider differently if you were to start over Who is Mihai Nichisoiu? Mihai Nichisoiu started his trading career as an independent player in futures currencies, and turned to spot forex in early 2002 when in the same time became one of the most popular contributors on various forex forums across the board. In December 2003 he founded Forex Grand Capitals, home for old fashioned trading where he currently features his own market positions in due real-time mirroring personal managed accounts activities. Mihai also holds special cooperation and writes on daily technical picks on several elite forex portals worldwide, including FxStreet. Great supporter of presenting his trading performance in the most fair play way, Mihai's technical picks and trading signals enclose Account Statements measuring the overall performance of his model portfolios in real-time. Session Transcript: FXstreet Moderator (Nov 26, 2004 10:01:29 AM) Good morning, good afternoon, and good evening to all of you joining us today from different parts of the world. Welcome to today's Live Forex Expert Question and Answers session. FXstreet Moderator (Nov 26, 2004 10:01:46 AM) For those who are unfamiliar with chat sessions like this, please feel free to ask questions at anytime, though the questions will be answered at the end of the session. When you place any questions of any sort they will be posted directly to me, the moderator, before I pass them on to our guest expert. If there are questions directed to me I can reply privately to the person asking the question if that is needed. FXstreet Moderator (Nov 26, 2004 10:02:20 AM) A Special Note: An abbreviated summary of today's chat will be made available online some time after the conclusion of the session. For those of you that would like to receive the transcript in full please feel free to let me know at the conclusion of today's discussion by sending me your email address. FXstreet Moderator (Nov 26, 2004 10:03:01 AM) With all that said, it gives me a great deal of pleasure to introduce Mihai Nichisoiu, Chief Trader at Forex Grand Capitals. Mihai holds special co-operations within Forex and writes extensively on the markets. In December 2003 he founded Forex Grand Capitals, home for old fashioned trading where he currently features his own market positions in due real-time mirroring personal managed accounts activities. Mihai (Nov 26, 2004 10:03:58 AM) Firstly I kindly salute and thank all the participants, Henty and FxStreet for scheduling the chat. We have around one hour running so let's get to work. Mihai (Nov 26, 2004 10:04:24 AM) Henty is too generous in calling me an 'expert'. Take me only as a regular Joe, one main reason for which I'm staying here talking is that I've made so many loads of mistakes in the past that you won't probably have time to do in a whole life-time. There might be lessons to learn from victories too, but we people have a hidden talent to always delay or not hearing at all of subtle messages behind victories - and I don't mean about the markets work alone. Mihai (Nov 26, 2004 10:05:10 AM) While talking up with Henty these days I said I wouldn't want to make a whole lotta deal of my - you know - methodology of personal trading. Perhaps ironically, perhaps not - I've been making a long time journey from very basic stuff like bars and candlesticks, to trading sophisticate indicators and even into shades of mechanical trading, just to eventually getting back to the same old plain business of working with primal bars, candlesticks, and patterns. Mihai (Nov 26, 2004 10:06:00 AM) After few years spent in the markets I've completely given up chasing market puzzles and black suit kind opinions. This is like Hollywood a mechanism I cannot control except in a very small number of situations when it's me who chooses when, where, and with what kind of ammunition I'd be trading. Mihai (Nov 26, 2004 10:06:42 AM) This is also like saying my first rule for money management is just staying selective and accomodative. I always ask myself will I be the predator or will I be the hunted creature. I would never go fighting a war driving a Mini instead of a Hummer. And if the heat comes around the corner I must be ready to hit the road in a matter of seconds. Mihai (Nov 26, 2004 10:07:44 AM) I also certainly don't want to enter too much details about my own modus operandi since this way I have absolute freedom on re-inventing the whole deal tomorrow if I want - even if 're-inventing' nowadays means mostly just fine-tuning. Always - and I mean always, no matter the hundreds of pips you gained or lost one day, week, or year - allow yourself the possibility of re-inventing what you do the very next morning, if needed. Mihai (Nov 26, 2004 10:08:27 AM) Not in the last row I wanted this chat be as interactive as possible. I'm not really a fan of putting up text for ebooks or fancy presentations, I know my work extremely well and that is always brief and straight to the point. Mihai (Nov 26, 2004 10:09:34 AM) That's why I'll farther attempt responding to as many questions as possible. I'll anyway start telling you most of the questions I received beforehand focused on indicators and non-discretionary trading - which actually isn't really a wonder for me. They also focused way too much on technical analysis aspects - which is no wonder either. Let's start up: ____________________________________________________________________ Please note the full transcript of this session was made available to those that attended only. ____________________________________________________________________ Mihai (Nov 26, 2004 11:14:15 AM) Well, time now to conclude the chat session, and enter the weekend. I once again thank you kindly for having been with me for this hour, with the help of Henty's maybe we will see each others again in the future. Also an occasion for me to wish you excellent winter holidays from now on. FXstreet Moderator (Nov 26, 2004 11:15:53 AM) We at FXstreet.com would like to thank Mihai Nichisoiu for being our guest expert, and also thank you all for participating in today's Q&A session. I hope that you found the session both interesting and educational. FXstreet Moderator (Nov 26, 2004 11:16:07 AM) Please feel free to post any feedback about today's session. Say what you thought was good and bad and what you think could be improved. We would very much appreciate this. I will be logged on for a while longer. The feedback will go to me only. FXstreet Moderator (Nov 26, 2004 11:16:28 AM) As well, if you would like to receive a transcript of today's session please feel free to send me your email address at this point. Date: March 17, 2005 15:00 GMT Expert: Mihai Nichisoiu, Chief Trader of Forex Grand Capitals Topics: - Strategic vs. predatory trading: technical tools to consider - Trading visions vs. trading reality: which, when and how to apply - Price pattern recognition: trading language spelled in all financial markets Who is Mihai Nichisoiu? Mihai Nichisoiu has started to trade in futures currencies in the late '90s, then turned to spot forex in early 2002 when he also became one of the most popular contributors on several specialized forums across the board. Currently, Mihai trades his own account as well as private and institutional money being hosted by Forex Grand Capitals - website which he founded in late 2003. Within the same professional hosting, Mihai offers a daily emailed service in which he features key market comments and real-time market standings on a timely, selective basis. Mihai is a strong advocate of old fashioned, plain business of trading - as well as one of presenting overall trading performance with a detailed track record. Session Transcript: This may be seen as a continuation of the open talks I had here in late November last year - and just like then I now have to stress out again I'm no educator, analyst, adviser, medium or whatever else which would assume like wearing a black fancy suit and having the latest eBook written by myself here with me to feature. I'm only a trader and I'm just as good as my trading performance shows, nothing more, nothing less. I do not count my 'pips', I do not backtest nor simulate trading action - as I only speak in terms of genuine returns, drawdowns, account statements - and what I do in trading straight to the point. My professional interest in this business grows progressively toward managing accounts for high-net-worth investors and hedge funds across the board looking for performance over the long-run - but I'm also gladly involved in periodic trading contests and circuits when they present themselves since I always appreciate the challenges of being assessed in real market conditions and with a real track record put on the table. Even though I'm still up to making fine-tuning adjustements if they're needed - my trading approach hasn't changed much since November. Versus the mundane style in trading forex nowadays which assumes acting on intraday timeframes and doing that rather around the clock (not meaning it'd be anything wrong about it, though) - I still follow a more passive decisional circuit mainly based on 'reading' the 1-day charts across the board. I do that since my mind and body don't seem to respond too well to the quick and repeated intraday - or even intrasession - market developments. Secondly - there's always the problem of having to deal with administrative costs like broker's spreads and rollover interests. You should make some simple maths, computing for instance how much you'd pay on an yearly basis for cumulative spreads assuming you'd trade 5 positions on even a major pair every day. You'd be amazed by the number of times your account should be larger at the end of the year only for covering those cumulative spreads. I made such model calculation some time ago - ironically based on a hint idea caught from...a broker advertisment. Moreover - while acting on the 1-day charts I always have the privilege of managing risk into two separate positioning stances: the predatory one (i.e. aggressive market standings lasting for only 1-3 days, and usually based on a single-candlestick price pattern), and the strategic one (i.e. market positions initiated with very small funds at the start-up, further funds adding assumed once expected direction and momentum are confirmed, and usually based on a multi-bar price pattern). Well - toward the strategic positions the risk profile virtually assumes way larger reward than risk - and since such positions are initially entered on an underleveraged basis and adding further funds is assumed once expected market conditions do confirm outright, realized losses once a failed start-up happens are extremely modest. On the other hand though, - the predatory positions are usually entered with larger funds and they also usually feature a poor risk profile i.e. larger risk than reward. Predatory positions in my opinion are similar to discovering very tight trading window opportunities deriving from excellent technical setups, and exploiting them very aggressively with a 'hit & run' approach. Problem is - always - that without discovering and effectively trading strategic positions and hence build a chance to shoot for those large rewards, I will have a growing vulnerability in taking the other sort of positions i.e. the predatory ones. For instance if I register 4-5 consecutive losses from taking predatory positions - for that's not an impossible nor rare situation - and there's no strategic trading opportunity around the corner to take benefit of, then I really do have a problem. Zooming to the technicals, - I always search out for basic things like classic candlesticks pointing out to trend reversal or continuation, and classic multi-bar patterns. I trust my instincts a lot, and I already have a pretty reasonable visual experience to rely on at most times. The 'bear/bull traps' remain my most favorite technical setups - for instance a textbook 'bear trap' recently occured on the USD Index (February 28th), and EUR/CHF (March 1st) on their corresponding 1-day charts which pushed for powerful bullish follow-thru in the wake of the 'spike-low' part of the pattern. These technicals make out for very selective material - therefore I don't trade nearly as often as most traders, I guess. I don't rush out because there's no hurry to reach anywhere. Plus as everything stays with me on a full discretionary basis at times I also feel the need of cooling trading down - even though I tend to work way better under pressure rather than in relaxed conditions. Moving to another topic, - I believe a lot of people are interested in whether to trade the reality of the charts (i.e. what's going on with the price right now) or doing it based on forecasts and various predictions. Somehow I believe this is sort of a fake dilemma. Well - I think even those ones pretending they always trade the present are themselves in the 'forecasting' business even if they don't really feel that way - because market moves anyway, and it should do it the way you expect for earning some money out of it. On the other hand - I personally think those ones trading based on 'forecasting' models should too have a powerful sense of what's happening right here, right now with the price. Easy say I know - because anyone of us can at times easily be trapped into choosing to act like on a couple of minor reversals on a 1-week chart, while at the same time a big 3,000-pip trend is quietly walking alongside. But, a good exercise always remain stepping off from the monitor for a couple of inches, and asking yourself about what is going there (i.e. on the longer-term chart). A few times perhaps something really big is moving just alongside - and those few times actually can make the whole big time difference between ending up an year at breakeven (or worse), and ending it up a few times better than the average industry performance benchmark. Like in any business, the best performers are those who have a very good sense of reality as well as a grand vision of the future. Sura www.fxstreet.com

-

Ai aici toate detaliile despre aceasta strategie

-

Una singura pentru o perioada sau mai multe deodata? Daca e ultima optiune nu e greu sa gestionezi atatea informatii? Asta si intentionez sa fac insa pana sa ajung acolo va trebui sa-mi inbogatesc considerabil bagajul de cunostinte si sa testez alte sisteme. Am renuntat la cel prezentat in primul post si de luni voi incepe cu LP50 al lui LazyPawn. Probabil ca mai tarziu voi reveni la primul deoarece e pe tabele zilnice si semnale apar rar. Multumesc mult pentru toate sfaturile, le voi lua in consideratie.

-

Am implinit o luna de cand am inceput sa studiez aceasta jucarie minunata. Mi-am spus ca daca vreau sa construiesc ceva pe termen lung, care sa reziste trecerii timpului, e bine sa construiesc pe o temelie solida. Asa ca am inceput cu babypips.com si incrediblecharts.com . In paralel citeam si articole de pe investopedia si fxstreet. Am citit si doua tutoriale (unul dinte ele e aici pe forum pe undeva) si mi-am facut conturi pe moneytec, elitetrader, MMG, Forex TSD si StrategyBuilderFX unde am citit articole din sectiunea "Beginers". De asemenea mi-am deschis un cont demo la Oanda. De o luna incoace minim 3 ore/zi le petrec citind materiale din sursele prezentate mai sus. Si cum am citit peste tot ca e bine sa urmezi un plan de tranzactionare m-am decis asupra forex[/acronym]-school/create-system-3.html"]acestuia Problema este ca simt ca din ecuatie lipseste ceva, ceva esential. Sistemul de mai sus ma tine foarte putin timp pe grafice, sa zicem 15 min max/zi. In 3 sapt. am prins doar un singur trade pe eur/jpy la care am facut cam 100 de pipsi. Simt ca am neglijat partea practica, e ca si cum as fi citit un dictionar fara sa incerc sa leg propozitii sau sa fac conversatie. Nu imi doresc sa castig mai multi pipsi/zi, nu sunt lacom. Imi doresc doar ceva mai sofisticat care sa ma atraga mai mult spre tabele, sa ma tina mai cu sufletul la gura, sa inglobeze mai multe unelte. Nu stiu daca va mai aduceti aminte cum erati dupa o luna dupa ce ati inceput sa va jucati cu forexul insa as avea nevoie de un sfat: sa incerc un alt sistem pe o perioada mai mica ( 4h ), sa pastrez sistemul insa sa lucrez pe tabele de 4 ore, sa pastrez sistemul si sa ma joc pe tabele sau ce sa fac? Sunt intr-un punct in care nu stiu ce directie sa apuc, ajutorul vostru mi-ar fi de folos, va multumesc anticipat.

-

Ma ofer sa ajut, programere nu stiu, pot traduce sau pot face alte chestii care le sugerati. Va stau la dispozitie in limita cunostintelor mele. Voi incerca sa fac pe buchinistul o biblioteca virtuala cu cele mai bune materiale despre trading, spatiul este nelimitat si linkurile permanente, se speram ca nu vor fi probleme legate de copyright. Deja am uplodat 3 carti care se gasesc mai greu Legat de partea cu semi-privat. Opinia mea e ca mai bine se ofera acces tuturor la forum insa sa fie conceputa o zona in care sa ai acces doar pe baza de invitatie, pentru discutii cu un grad mai mare de profesionalism.

-

Gasesti aici cartea lui Robert Balan, nu tebuie sa te grabesti, linkul este permanent. Va sfatuiesc sa verificati periodic pagina buchinistului, materiale legate de forex vor fi uplodate constant. Daca aveti vreo dorinta poate Buchinistul o va indeplini

-

Are cineva "'Trading in the Global Currency Markets" scrisa de Cornelius Luca? Daca o aveti va rog sa o uplodati undeva sa o pot lua si eu, mi-as dori foarte mult sa o citesc. Daca sunt doritori pentru cartea lui Robert Balan, "The Elliott Wave Principle Applied to Foreign Exchange Markets" va rog sa spuneti

-

Citind despre Elliot Wave Theory am dat peste un documentar foarte interesant, History's Hidden Engine. M-a surprins foarte mult complexitatea lui, pana unde a indraznit sa se duca si conexiunile dintre domenii care aparent nu au nicio legatura intre ele. O intreaga stiinta intitulata socionomics s-a dezvoltat pe baza teoriei lui Elliot. Sunt curios ce parere au despre acest documentar cei ce au citit cartile lui Nicolas Nassim Taleb, eu nu am ajuns pana acolo insa o voi face cu siguranta. Click aici pentru a viziona filmul Pun mai jos un interviu cu producatorul acestui documentar, David Edmond Moore Q: What inspired you to create a documentary on socionomics? A: I first became interested in socionomics after reading Bob Prechter's report, “Popular Culture and The Stock Market.” It was the first time I had heard of the Wave Principle. I found it remarkable that the stock market correlates with trends in fashion, movies and music. I wasn't really a finance guy. I was just out of school, and pop culture was what interested me. What drove it home for me was that after reading the report I noticed a correlation between the crash in 1987 and a change in the music of U2 and R.E.M. Both groups went from being just rock bands to releasing two very political albums in '87. Later still, after the market recovered from the '87 crash and we extended the massive bull market through the late '80s and '90s, U2 and R.E.M. released "happy" albums. U2 went so far as to call their album Pop. You can't say it any clearer. It was only later that I found out about the true breadth of the Wave Principle—that it doesn’t stop with the markets or even pop culture, but correlates to politics, the economy and—most exciting—biology and psychology. To think that U2 releasing an album called Pop coincident with one of the strongest, positive times in our society could have primal underpinnings was amazing to me. The more I read Prechter's work, the more I realized that visuals would really drive socionomic ideas home. So a documentary was the obvious route. Q: What were your greatest challenges in producing the film? A: I could talk for a month about that topic! It was the first documentary I’ve made, so that was the first challenge. I had had some success in short fictional narratives and on-demand work, so at first I applied the same approaches to the documentary, and they didn't work. I had to wrap my head around what a documentary is. I realized that documentaries aren’t all the same, that there is a variety of approaches. The one thing I didn't want to do is make a film in the style of Michael Moore—you know, inserting my ideas and opinions into the documentary, as opposed to staying behind the scenes. Also, I knew that the ideas behind socionomics were too new and complex to explore every aspect and create a debate on film. I decided to create a piece that laid out the basic ideas with plenty of examples in a very accessible form. My hope is that this will then start the debate, and these ideas will be thoroughly examined, and socionomics can move to the next stage toward becoming a science. Q: What intrigues you most about socionomics? A: The most important thing is its potential to change the way we look at the world. It is obvious that initiative in creation, exploration and knowledge are driving forces of humankind. The quality ideas that Prechter and the others at the Socionomics Institute have put forth help further these pursuits. How could adding to these areas not be exciting? It's like an archeologist unearthing an ancient artifact and then hypothesizing about the role it once played in the world. I've always thought the Wave Principle and socionomics had this type of parallel, just in a more philosophical way. Also, it's cool to be part of an early science and help the ideas develop. I feel like I'm a part of something still uniquely underground and thriving, like discovering a great new movie or band before anyone else. I don't mean that in a pretentious way. I mean that whenever you discover something new that you are interested in, it reshapes the way you think, and who you are in general. Socionomics—its whole design—reshapes the way you think. Vizionare placuta si astept parerile voastre!

-

Hi folks. Many of you don't know, but I used to be involved in training people in various things (not trading) and I thought I might share with you the journey that you take when beginning anything new. also if I show you my kind of writing style you might just buy my beginners forex book This cycle is as true for trading as it is for learning to drive a car and consists of five components. I'm going to take you through each stage so you can recognise exactly where you are in your trading journey. Step One: Unconscious Incompetence. This is the first step you take when starting to look into trading. you know that its a good way of making money cos you've heard so many things about it and heard of so many millionaires.Unfortunately, just like when you first desire to drive a car you think it will be easy - after all, how hard can it be?? - price either moves up or down - what's the big secret to that then - lets get cracking! unfortunately, just as when you first take your place in front of a steering wheel you find very quickly that you haven't got the first clue about what you're trying to do. you take lots of trades and lots of risks. when you enter a trade it turns against you so you reverse and it turns again .. and again, and again. you try to turn around your losses by doubling up every time you trade - sometimes you'll get away with it but more often than not you will come away scathed and bruised Well this is stage one - you are totally oblivious to your incompetence at trading.Stage one can last for a week or two of trading but the market is usually swift and you move onto stage two. Stage Two - Conscious Incompetence Stage two is where you realise that there is more work involved in this and that you might actually have to work a few things out. you consciously realise that you are an incompetent trader - you don't have the skills or the insight to turn a regular profit. During this phase you will buy systems and e-books galore, read websites based everywhere from Russia to the Ukraine. and begin your search for the holy grail. During this time you will be a system whore - you will flick from method to method day by day and week by week never sticking with one long enough to actually see if it does work. every time you came upon a new indicator you'll be ecstatic that this is the one that will make all the difference. you will test out automated systems on Meta-trader, you'll play with moving averages, Fibonacci lines, support & resistance, Pivots, Fractals, Divergence, DMI, ADX, and a hundred other things all in the vein hope that your 'magic system' starts today. you'll be a top and bottom picker, trying to find the exact point of reversal with your indicators and you'll find yourself chasing losing trades and even adding to them cos you are so sure you are right. You'll go into the live chat room and see other traders making pips and you want to know why it's not you - you'll ask a million questions, some of which are so dumb that looking back you feel a bit silly. You'll then reach the point where you think all the ones who are calling pips after pips are liars - they cant be making that amount cos you've studied and you don't make that, you know as much as they do and they must be lying. but they're in there day after day and their account just grows whilst yours falls. You will be like a teenager - the traders that make money will freely give you advice but you're stubborn and think that you know best - you take no notice and over leverage your account even though everyone says you are mad to - but you know better. you'll consider following the calls that others make but even then it wont work so you try paying for signals from someone else - they don't work for you either. This phase can last ages and ages - in fact in reality it can last well over a year - My own period lasted about 18 months. Eventually you do begin to come out of this phase. You've probably committed more time and money than you ever thought you would, lost 2 or 3 loaded accounts and all but given up maybe 3 or 4 times. Then comes stage 3 Stage 3 - The Eureka Moment Towards the end of stage two you begin to realise that it's not the system that is making the difference. you realise that its actually possible to make money with a simple moving average and nothing else IF you can get your head and money management right You start to read books on the psychology of trading and identify with the characters portrayed in those books. Finally comes the eureka moment. The eureka moment causes a new connection to be made in your brain. you suddenly realise that neither you, nor anyone else can accurately predict what the market will do in the next ten seconds, never mind the next 20 mins. You start to work just one system that you mould to your own way of trading, you're starting to get happy and you define your risk threshold. You start to take every trade that your 'edge' shows has a good probability of winning with. when the trade turns bad you don't get angry or even because you know in your head that as you couldn't possibly predict it it isn't your fault - as soon as you realise that the trade is bad you close it . The next trade will have higher odds of success cos you know your simple system works. You have realised in an instant that the trading game is about one thing - consistency of your 'edge' and your discipline to take all the trades no matter what. You learn about proper money management and leverage - risk of account etc etc - and this time it actually soaks in and you think back to those who advised the same thing a year ago with a smile you weren't ready then, but you are now. The eureka moment came the moment that you truly accepted that you cannot predict the market. Then comes stage four Stage 4 - Conscious Competence Ok, now you are making trades whenever your system tells you to. you take losses just as easily as you take wins you now let your winners run to their conclusion fully accepting the risk and knowing that your system makes more money than it loses and when you're on a loser you close it swiftly with little pain to your account You are now at a point where you break even most of the time - day in day out, you will have weeks where you make 100 pips and weeks where you lose 100 pips - generally you are breaking even and not losing money. you are now conscious of the fact that you are making calls that are generally good and you are getting respect from other traders as you chat the day away. You still have to work at it and think about your trades but as this continues you begin to make more money than you lose consistently. you'll start the day on a 20 pip win, take a 35 pip loss and have no feelings that you've given those pips back because you know that it will come back again. you will now begin to make consistent pips week in and week out 25 pips one week, 50 the next and so on. this lasts about 6 months then comes Stage Five Stage Five - Unconscious Competence Now were cooking - just like driving a car, every day you get in your seat and trade - you do everything now on an unconscious level. you are running on autopilot. You start to pick the really big trades and getting 100 pips in a day is becoming quite normal to you. This is trading utopia - you have mastered your emotions and you are now a trader with a rapidly growing account. you're a star in the trading chat room and people listen to what you say. you recognise yourself in their questions from about two years ago. you pass on your advice but you know most of it is futile cos they're teenagers - some of them will get to where you are - some will do it fast and others will be slower - literally dozens and dozens will never get past stage two but a few will. Trading is no longer exciting - in fact it's probably boring you to bits - like everything in life when you get good at it or do it for your job - it gets boring - you're doing your job and that's that. You can now say with your head held high "I'm a currency trader" I hope you've enjoyed this text and can recognise yourself in some stage or another - personally I'm at stage four now and am constantly making good amounts of pips - I've been trading in total for about 3 years and the first two were hell on earth. for those of you reading this who stick with it, ill look forward to the banter we have together in the future when we are both bored to death during the trading day Dupa 18 luni vine completare Hello everybody. Can't believe that it's 18 months since I wrote that thread - Jan 2005 it was. Well, as they say 'you never stop learning in this game' and that's certainly true. I thought it was time to add to the original thread with a new one - my last 18 months have been very interesting and many things have happened that I thought I would share with you that you may find useful. At the time I wrote that thread I was an intraday trader and had been making money consistently for about 18 months - I thought that was it, I had made it as a trader and was at the end of my learning curve. How wrong I was. I don't think that this series of threads will ever end, I expect I will be writing another update in 2008. When I look back at the last 18 months I cant believe how much ive changed from what I thought was the end of my cycle. At the time I was daytrading several strategies which made me money. In the ensuing months I just kept on testing new ideas - reading systems on here and other forums and testing them also. I got together with a bunch of traders in voice rooms and again started working on systems and testing. - again day in day out testing and trading - making money yes but never really getting closer to that dream that we all have of trading /easily, without emotion/ and having that millionaires lifestyle. Systems development started to become easier when I looked at the market holistically - I.e. not tying myself down to a single timeframe and watching at a macro level as well as a micro level. This resulted in the several screens I now have in my office so I could see all the timeframes at once - I was still specialising in GBP as to have more meant yet more screens and I thought that the study of cable would make me more than enough money. I did what many of you will do in the future. I developed systems, gave some away and sold some also - The Hilda system was in my opinion my crowning glory - a system that I could trade on any timeframe on any currency. I spent the time and sold my system to many people. When the fun of selling that and helping others died down I again started improving on it etc etc etc. But then the realisation started to hit me. All of this system work, selling etc wasn't getting me any closer to my goal of actually enjoying the money I was making. You see a journey to a goal is a weird thing. all of the fun is in the actual journey to the goal and when you get there its very easy to start moving backwards to do it again. what i'm about to explain to you is I think the final cycle in the journey to be a great trader and realising your ambitions. I may be wrong and find a Eighth step within the next two years lol - but for now this is the best I can offer you. *Step 6 The wake up call When the newbie trader reaches step five he/she thinks that's it. They now make money well, look back on the forums and chat rooms they've used for so long and with a smile see the struggle they have been through repeated day after day as new people begin their journey. They see the highs and lows that they experienced, the heartache, the 'head in the gas oven' moments and the movement from sheer despair to brilliant exuberance. They continue to design systems to test - spend hours upon hours of hand testing with a smile - they know that no amount of computer testing is good enough to give you the confidence to trade the system properly. They test and test - still believing that there is a system out there which beats the one they are using now. They continue to get the latest designer indicator - hell, they even pay for them now as they know that a few hundred bucks for an indicator is worth it if it increases the take. Trading becomes a real chore and the rot starts to set in. Here they are watching charts all day long for that setup which pays the mortgage and buys the new car or house. The system they are using is still indicator based, still needs a shedload of charts open and still relies on a good charting feed. Even though they don't realise it for the most part, although their system is mechanical they still have decisions to make - when to close a trade, when not to trade, avoid the news etc etc. One day they wake up..... *Step 7 - Learning NOT to trade Yep, you read it right. what happens to a trader in this cycle is that they get so wrapped up looking for improvements to their trading that they forget what they started trading for in the first place - for freedom. Yet here they are every day sat by the pc, still after 4 or 5 years testing new stuff, taking trades and even though they don't realise it making discretionary decisions on their trading. If they want to go out for the day of course they can - and they can enjoy their money. but whilst they are away they make no money because their systems main component is themselves. Here's what's happened. The definition of success according to Earl Nightingale is the realisation of a worthy goal. however success isn't all it's cracked up to be. The journey to this point in the traders life has been exciting, exhilarating, despairing and all of those things we call emotional. This emotion is like a drug and we get used to it - it takes so long to reach our goal that the highs and low's become a part of our personality. when we reach the goal - we can't stop. until the wake up call of course. At this point we realise that the answer has been staring us in the face from every book we ever read, every forum we visited and in reality every trade we ever made. In stage seven the trader realises he needs to work on one more system - the last one he will ever work on. (I think!) It will be completely mechanical. No user decisions to make, no worry about news, no worry about what the 'experts' say or what's happening in the news. Now some traders will pooh pooh this - many city traders work on fundamentals etc etc - but ask yourself the question - if they are so good why aren't they trading their own accounts? Anyway, this is my experience and not theirs - these two extra steps are what's happened to me and that's why I did it in a new thread as opposed to tagging it onto the first one which is kind of generic. so in stage 7 the trader starts to work on this totally mechanical system and after a lot of backtesting by hand and parameter changes etc etc he finally has it. he can now work for a few minutes a day or even automate the system and not work at all. if he wants to go out then he makes money whilst he's out. This is the stage I'm now at and happily enjoying the money I'm making and I may be wrong but I think that's what the majority of people who come into this business would like to happen. This stage will make me rich beyond my wildest dreams. but what you reading this have to realise is that you MUST go through all that shit to get here - it's like going from being a teenager to being an adult - there are no short cuts. That's why I laugh when I see people posting that they are consistently profitable after a few months or even a couple of years - they may be, but it wont be for long. I think that even if you say this in chat rooms and on forums like this you know the truth yourself. So that's the last two stages at the moment - might get bigger with more steps in the future though cos I don't know what I don't know yet. you may be at this stage and you may be wondering how you will know if you have a truly mechanical system - well if your system is truly mechanical you should answer the following questions with a yes. 1. do you have a clearly defined entry point that wouldn't change no matter who was trading the system? 2. Do you have a clearly defined stop level that would not change no matter who was trading the system? 3. If NFP or a similar high volatility news item was due in 3 seconds and your system signalled an entry would you take it? 4. Do you have a clearly defined way to close your trade that would not change no matter who was trading it? 5. could you tell your 12 year old son what to do to trade the system and his results would be no different to yours? If you answered truthfully 'yes' to each question then congratulations you have a truly mechanical system - now you've got to make sure it makes money - that bit is up to you. Hope this helps some out there who are struggling away. Know that there is a light at the end of the tunnel, but it's a bloody long tunnel! see you at the light end From The Desk Of ... Soultrader As dori sa raspunda in special traderii cu o vechime mai mare, va regasiti in acest articol. Ati parcurs toti acesti pasi?

-

Fata Moragana scria pe alt thread: "mi-am propus un tel de-a dreptul ambitios: sa "incheg" o comunitate forex romaneasca". Cred ca un pas important si destul de usor de realizat ar fi sa organizam niste intalniri lunare, trimestriale, in functie de posibilitatile fiecaruia. Asa cred ca ar fi mult mai usor, ne-am cunoaste mai bine si am impartasi idei. Nu stiu daca blogurile au avut rezultatul scontat (aici poate ne spun cei 2 realizatori care a fost traficul), insa realizarea unui site despre forex cu forum, asa cum s-a spus pe alt thread ma face sa cred ca telul de mai sus este pe ultimul tur de pista. Intalnirea probabil ar marca intrarea pe linie dreapta. Ce parere aveti?

-

Fiind mai patriot m-am intrebat daca exista si romani de succes in acest domeniu. Din ce am apucat sa citesc pana acum despre forex am dat peste 2 nume care suna mioritic: Cornelius Luca, economist la GFT si Robert Balan, Head of Financial Markets Strategy at Saxo Bank Ambii au niste studii foarte bine privite pe piata (nu am apucat sa le citesc) Robert Balan, Head of Financial Markets Strategy at Saxo Bank "Mr. Balan is Head of Financial Markets Strategy at Saxo Bank A/S. Mr. Balan is viewed as one of the financial sector's most-respected advisors in the area of technical analysis of financial markets. He earned his reputation as head of technical analysis and strategy at Lloyd’s Bank , Swiss Bank Corporation, Union Bank of Switzerland and at Bank of America, and his analyses are regular features of Reuter’s news service, and Market News International. Robert Balan is the author of the best-selling book on analysis, The Elliott Wave Principle Applied to Foreign Exchange Markets. Mr. Balan is a world-leading market strategist and is able to comment on global market trends from a technical-analytic perspective. His areas of expertise include equities, foreign exchange, bonds, precious metals and commodities." "Robert Balan is a first-class talent, absolutely at the top of the field. We have had clients asking for more access to Robert’s ideas and now we are delivering it", explains Executive Director and Head of Global Trading, Claus Nielsen. "TradeMaker is an efficient approach for the professional trader. It defines a very clear set of specifications for the strategy. The trader can choose to follow that strategy or go in a direction of his or her own. These are real trading ideas", says Claus Nielsen. Click aici pentru mai multe detalii Cornelius Luca, economist la GFT "Mr. Luca is an internationally renowned foreign exchange and technical analysis expert. He has more than 20 years of experience in the currency markets; he had traded spot, forwards, futures and currency options at Creditanstalt Bankverein (now Bank Austria), Prudential Securities and Sanwa Bank (now UFJ). He is the author of 'Trading in the Global Currency Markets' (Second edition 2000, First edition 1995), 'Technical Analysis Applications in the Global Currency Markets' (Second edition 2000, First edition 1997), both published by Prentice Hall, 'Technical Analysis Applications', 2004, published by McGraw-Hill and 'Practical Introduction to Technical Analysis', 1997, published by Euromoney. He has conducted training programs in FX and Technical Analysis around the world since 1989. Mr. Luca holds and MBA from the New York University Stern School of Business with a double major in International Business and Finance" Click aici pentru detalii Postati daca ati citit aceste carti parerea voastra, oricum par foarte tehnice si sunt destul de apreciate pe afara. Mai cunoasteti astfel de romani? Daca subiectul e fumat scuze Later edit: Am gasit urmatorul articol: "The American analysis guru Robert Balan has joined Saxo Bank A/S as head of financial markets research. Balan is viewed as one of the financial sector's most-respected advisors in the area of technical analysis of financial markets. He earned his reputation in positions at Lloyd’s Bank and Bank of America, and his analyses were regular features of Reuter’s news service. Robert Balan is the author of the fundamental book on analysis, The Elliott Wave Principle. NewsStory = With the hiring of Robert Balan, Saxo Bank further strengthens its analysis capacity at a time when the chaotic conditions in the international financial markets make it more difficult than ever to predict developments in foreign currency exchange and stocks. His employment also comes as part of a general bolstering of human resources as a direct result of Saxo Bank’s success. "I wanted a position where I could use my abilities and experiences as a market analyst in a more direct relationship with investors. It is precisely SaxoTrader that gives Saxo Bank a trading platform for drawing investors very close to the market," says Robert Balan. "Saxo Bank is deeply engaged in developing new, exciting net solutions and top-rate analysis. Combined with the bank's service and product mix, Saxo Bank has designed the optimal framework for the active international investor - a framework I intend to take an active role in building." Saxo Bank is Denmark's most dynamic international investment bank, with customers in more than 80 countries around the globe. The larges part of investment activity at Saxo Bank is handled through the advanced Internet-based trading system, SaxoTrader, which is one of the financial world's most effective tools for trading in foreign exchange, FX options, and stock CFDs. The system will be enhanced in the near future to include trading in physical stocks and futures. "Saxo Bank is incredibly happy to be able to offer Balan's valuable recommendations to our clients around the world. Hiring him is an important step forward for Saxo Bank and a natural advance in the rapid development of Saxo Bank, despite the international financial crisis, "says Kim Fournais, CEO of Saxo Bank. Robert Balan is also well known to analysts around the world for his book, The Elliott Wave Principle Applied to Foreign Exchange Markets, which The Society of Technical Analysts in London called the best book ever on The Elliott Wave Principal. In recent months, Robert Balan has worked with his own analysis firm, Finance Technology Solutions. He continues to work from New Jersey, but will be moving to Denmark as soon as possible." Nu prea pare roman in poza

-

Si site si blog, e un lucru excelent, imi pare rau ca sunt la inceput si nu prea am cu ce sa ajut , daca este ceva ce pot face cu cea mai mare placere. S-a oferit hosting si blog, sa vedem cine se incumeta 8->

-

O zi buna tuturor! Cum acesta e primul meu post aici ar fi frumos sa ma prezint: ma numesc Dragos, am 22 de ani, lucrez in domeniul bancar (entry level) iar de forex am auzit mai de mult insa pot sa zic ca maine am o saptamana de cand m-am apucat sa vad cu ce se mananca. Am descoperit pe acest site informatii extrem de pretioase, la obiect, foarte bine structurate si oameni valorosi care stiu ce vorbesc. Am observat ca vara asta se poarta blogurile iar in lumea forex un blog este un izvor foarte bun de cunostinte, sau cel putin asa am observat din "aprofundatele" mele studii de o saptamana. Traderii experimentati au bloguri unde pun informatii, sfaturi, opinii, etc. Nu cred ca exista nici un blog romanesc despre asa ceva. Pe acest forum sunt oameni capabili sa faca asa ceva. Poate fi o sursa buna de informatie si raspandire a fenomenului in tara noastra. Acum nu stiu si parerea celor capabili sa realizeze treaba asta, daca vad rostul unui astfel de blog, daca sunt dispusi sa faca asa ceva sau daca au timp pentru a infaptui un astfel de proiect. Astept si parerile voastre. Daca nu vreti sa le spuneti macar votati in poll, poate asa ii determinam pe cei in masura sa realizeze un blog sa o faca (nu cred ca este nevoie sa ii numesc) 8-> O duminica placuta tuturor!