Bloguri despre trading și investiții

Blogurile comunității noastre

-

Ignat Ovidiu

Un blog de ovidiu_gnt în General- 2 intrări

- 0 comentarii

- 926 citiri

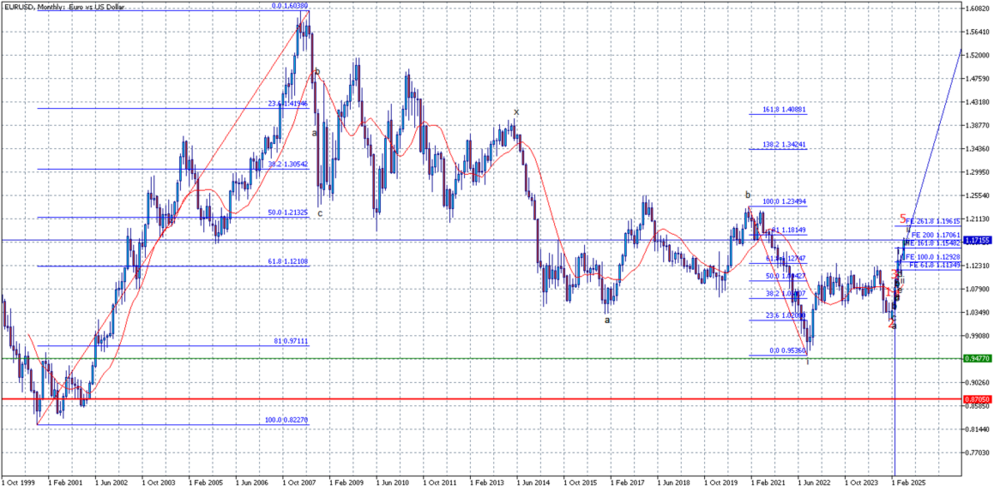

Analiză tehnică Elliott Wave

Latest entry by ovidiu_gnt,

Prima analiză, este pe graficul lunar, întrucât trebuie realizată o scurtă istorie a evoluției în timp, a perechii valutare Eur-Usd.

După cum se poate observa, în anul 2016, consideram că triunghiul format, este valul [b], al unui plat, iar mișcarea valului [c], urma să fie finalizată în intervalul 0,9477 - 0,8705.

Piața a decis, să nu se grăbească, anii au trecut, iar astăzi, avem o altă structură a corecției.

Ce consideram a fi plat, s-a transformat într-o dublă combinație. Tringhiul nu mai este valul [b], ci este val x, iar a doua combinație, are aspectul unui zigzag. Partea bună, este că intervalul deplasării, rămâne același.

De unde am dedus, acest interval? Rămâne să aflăm într-o postare viitoare, dacă sunt persoane interesate de acest aspect.

Toate cele bune!

Intrări Recente

-

In acest articol o sa trecem in revista lista cu evenimente importante din aceasta saptamana care vor produce miscari pe Piata. Lista trece peste ziua de Luni, deoarece nu vor fi evenimente relevante in aceasta zi .

Asadar:

Marti, 14 Ianuarie

Zona Euro va publica la ora 12:00 ora Romaniei, date despre productia industriala, un indicator care arata "starea de sanatate a economiei".

S.U.A va prezenta date despre vanzarile cu amanuntul, iar la ora 20:20 un important membru FED va tine un discurs care va fi indeaproape urmarit deoarece va indica viitoarea posibila directie a politicii monetare in ce priveste dolarul american.

Miercuri, 15 ianuarie

La ora 10:15 vor fi stiri importante in Elvetia, ceea ce va face sa apara miscari pe perechile ce contin franc elvetian, iar la ora 15:30 vor fi stiri in Statele Unite despre inflatia preturilor de productie, dar si un raport despre productia de bunuri din zona New York, zona care a fost grav afectata de frig puternic in aceasta perioada.

Joi, 16 Ianuarie

La ora 2:30 noaptea ora Romaniei vor fi stiri foarte importante in Australia, stiri despre somaj si locurile de munca de pe continentul din emisfera sudica, evenimente care vor face ca perechile AUD/USD, EUR/AUD sa inregistreze fluctuatii importante.

In zona Euro, incepand cu ora 9:00 pana dupa ora 12:00 vor fi publicate stiri despre inflatia preturilor de consum.

Dupa ora 15:30 va fi un set important de stiri pe Statele Unite, iar la ora 18:10 presedintele FED Ben Bernanke va vorbi la un eveniment din Washington.

Vineri, 17 Ianuarie

Sfarsitul de saptamana va fi plin de stiri foarte importante pe sesiunea Statelor Unite, stiri legate in special de piata imobiliarelor si de productia industriala.

Cam acestea sunt evenimentele la care va trebui sa ne raportam activitatea de tranzactionare FOREX in aceasta saptamana, saptamana care sper ca va fi una profitabila pentru toti traderii de valute care citesc acest articol.

Succes si spor la bani !

http://investitorforex.blogspot.ro/2014/01/saptamana-13-17-ianuarie-2013.html

Intrări Recente

-

Latest entry by Barbones,

Quantitative prop trader: 'I wouldn't try to raise the price of rice and starve China'

Joris Luyendijk meets a trader who says their approach is far from 'evil', but one of extreme caution and calculation

http://static2.businessinsider.com/image/4b9fdb117f8b9a0307960100-480/shadow-dollar-bills-cash-money-warhol.jpg

• This monologue is part of a series in which people across the financial sector speak about their working lives

"So far you miss a speculator, the finance bad guy," he wrote in the blog. "Well, that would be me," adding: "If we go for some food you'll be able to make one of those nice plate descriptions

" So we're meeting one harsh, cold February evening for dinner in Strada, an Italian restaurant opposite the now-evicted Occupy camp. He is an inconspicuous-looking man, originally from continental Europe. He orders a vegetarian pasta and sparkling water.

" So we're meeting one harsh, cold February evening for dinner in Strada, an Italian restaurant opposite the now-evicted Occupy camp. He is an inconspicuous-looking man, originally from continental Europe. He orders a vegetarian pasta and sparkling water.Source: Revista Presei

Intrări Recente

-

Pillaging The Pip

Un blog de tradelover în General- 18 intrări

- 51 comentarii

- 3435167 citiri

"Forex" with big "F" from "Fibonacci"

Latest entry by tradelover,

[postasem intai in "ce stiti despre tradelover" dar am dat click pe butonul ala cu "blog this" si cand am vazut ce face, m-am mutat pe blog, tot ziceam eu mai demult sa adun posturile la un loc..., asa nu trebe sa corectez greselile gramaticale in doua locuri, hehe]

Sper ca macar vreo cativa dintre voi sunteti calare pe raliul Bitcoin...

Eu am vo cativa, partial cumpăraţi, partial mineriţi, de anul trecut pe cand cursul era 13 parai pe btc. Asta apropo de intrebarea care mi-o punea cineva mai sus, "la ce imi trebuie 'supercomputer'". "Mineritul" este una dintre activitati. Dar nu cea ce baza, pentru ca placile care le am eu sunt mai bune pentru calcule in DP si mai proste la hash-uri. La minerit trebuie mult hash (calcul in numere intregi) si putin DP (calcul flotant in dubla precizie) deci invers. Dar despre asta cu proxima ocazie.

Ma sună un prienten vinerea trecuta (român, care traieste in ChiangMai de o bucata de vreme, ne vedem rar, ocazional, si discutam afaceri, bem o bere, băiat de treaba, Adi se recomanda), eu boleam, cu febra 39, cică "băh, ai văzut ce face bitcoinu?" Eu in pom, nu mai deschisesem minerii de mai bine de o luna... Cursul ajunsese din noiembrie pana acum la 38, dar de asta stia toata lumea. Joi nu stiu ce s-o fi petrecut in capul/calculatoarele alora, peste noapte BTC-ul a urcat la 140. Mi-a trecut febra brusc...

Practic, cine a avut 100 de BTC, s-a sculat mai bogat cu 10 mii de parai.

Omu' meu (cu care discutasem despre BTC anul trecut pe la craciun, mă intrebase si el ce fac cu atata amar de hardware, si mă privise cam intr-o dungă când îi zisesem de "monezi virtuale", cred ca se gandise "tradelover saracu a luat-o pe ulei"), imi cerea acum sfatul daca sa cumpere sau nu. Eu, circumspect precum ma stiti, i-am zis sa nu. Nu inca! Pt ca tot mi-a zis ca are un GPU vechi, l-am pus sa mine(re)ze o perioada, timp în care să citeasca la greu, să vadă ce si cum. Bitcoinu' a mai avut oscilatii, mai ales la inceputuri cand era usor de manipulat pt ca erau putini pe piata. Si - la fel ca in Forex - daca nu ai bani sa iti sustii beturile, (ceea ce noi aici am numi leverage mic) atunci poti sa pierzi grass. Foarte gras.

Acum nu am mai vorbit cu omul meu de vineri incoace. Nu s-a ivit ocazia...

Da' nici nu cred ca mai vorbeste cu mine vo cateva luni, hahaha... De ce? Bitcoinu' a batut azi dimineata 231.5 parai pe bucata. Pacat ca nu i-am zis sa cumpere, si sa mai fi cumparat si eu vreo o suta doua.... Daca continua asa inca o saptamana, fac bani sa ma intorc la Forex. No joke. Daca socotesc profitul din noiembrie incoace, stau pe 13 mii de parai, din care 12 mii facuti in ultimele 6 zile. Cu o investitie de mai putin de 1000 de parai, fara sa socotesc computere, curent consumat, etc., adica socotind doar banii dati pe BTC cumparati. Pe cei mineriti ii consider "for free" (desi adevarul e departe). Oricum, nu am de gand sa vand daca scade. Lasa sa fie acolo cativa "bituleţi", nu se stie la ce sunt buni. Dar nici nu mai cumpar... Bitcoinul-ul a ma avut nervi in trecut...

Spor mare la pipsuiala tuturor. Sper sa mai imi fac timp sa mai citesc pe aici, vad ca sunt o gramada de chestii noi.

P.S. de cand ma tot chinui eu sa mut postul pe blog, BTC-ul e $237.

Intrări Recente

-

Latest entry by d3cimus,

GERMANIA

Președintele:

Pe 18 martie 2012 Joachim Gauck a fost ales prin vot reprezentativ președintele Germaniei în urma demisiei de onoare a fostului președinte, Christian Wulff, in urma unui scandal legat de un împrumut personal în valoare de 500.000 euro de la soția unui influent om de afaceri german Egon Geerkens.

Născut în Rostok pe 24 ianuarie 1940, Joakim Gauck este un fost pastor lutheran a cărui tinerețe a fost dedicată luptei anticomuniste. Fiu al unui supraviețiutor al gulagului rusesc, preocuparea sa pentru drepturile omului este de notorietate. După căderea zidului Berlinului a fost cel ce a condus studierea arhivelor STASI timp de 10 ani dobândindu-și renumele de stasi hunter. Mai mult decât atât, a fost candidatul comun al verzilor și social democraților germani în 2010.

Cancelarul

Va fi ales în octombrie 2013 în urma alegerilor parlamentare. Dacă în ultimele 2 legislaturi Uniunea Creștin Democrată a avut majoritatea, nu se știe care va fi configurația viitoarei adunări; însă creștin democrații nu vor mai juca un rol similar cu cel din prezent, dacă e să ne luăm după alegerile care au avut loc în luna mai a acestui an în cel mai populat stat german (Rhin-Westphalia de nord) unde social democrații au câștigat ”în deplasare” cu 3-4 procente avans.

Statele Unite ale Americii

În luna februarie a anului curent diferența în sondaje între Romney și Obama era de aproape 6%. În favoarea lui Obama. La momentul redactării acestui material ea s-a redus la 0,01 %. Iar pe 6 noiembrie 2012 sunt alegerile. Miza este una colosală și depășește cu mult granițele americane.

Canada - Quebec

Partidul lui Pauline Marois (Parti Quebecois) a castigat pe 4 septembrie 2012 alegerile din cea mai bogata provincie a Canadei – Quebec. Pauline Marois a fost desemnat prim ministru al provinciei. În timpul discursului de investire au existat focuri de armă, atentatorul ucigând un tehnician de scenă. Parti Quebecois este la rândul său partid social democrat. Însă ceea ce este mai important este faptul că partidul are o puternică orientare secesionistă față de Canada, propuneri privind organizarea unui refendum în acest sens fiind așteptate.

Franța

Faptul că Franța – o republică cu o guvernare prezidențială – are un președinte socialist nu mai este un fapt care să constituie o noutate. Însă, așa cum era de așteptat, relațiile franco germane s-au răcit, socialistul Hollande fiind în opoziție politică și (se pare) economică cu creștin democrata Merkel.

Concluzie:

Toate aceste mici sinteze din situația politică a diferitelor țări cu monede forte au un element comun...... poate două: incertitudinea și socialismul. Mișcări de sorginte socială au loc în SUA (Occupy Wall Street de ex cu plecare Adbusters din Canada), în Spania și Grecia (cel mai cunoscute).

Nu încerc să creez un peisaj apocaliptic. După ani de recesiune în care cea mai mare parte a populației a trebuit să facă eforturi financiare și sociale, e normal ca aceste mișcări socialiste să capete avengură. Un discurs axat pe individ, pe drepturile lui și pe sacrificiile pe care nu mai trebuie să le facă este unul câștigător. Numai că unei crize globale îi corespunde o mișcare globală.

Investitorii sunt cele mai raționale ființe. Nu acționează impulsiv, nu au sentiment. Rezultatul cel mai important pentru el este rata profitului. Ori mișcare socialistă cu accent pe nevoia individului nu prea se încadrează în raționamentul său.

Investitorul nu iubește incertitudinea. Lupta cu riscul este una de prim rang în cadrul unui fond de investiții. Ori mișcarea socială nu este o mișcare care să pună accent pe raționamentul economic în primul rând.

Așa că investitorul preferă să aștepte. Să conserve capitalul. Să plătească dobândă negativă pentru franci elvețieni sau pentru obligațiuni nemțești. Adică pentru safe havenuri. Cred că ne vom întoarce parțial cu încrederea undeva în 2008-2009. Cred că în acest context a ajuns goldul la 1700 $ uncia. Cred că ăsta e motivul pentru care rezervele Swiss National Bank au explodat în acest an, s-au multiplicat (corelația cu peg-ul....... știți raționamentul).

Cred că băncile centrale din zona scandinavă vor avea o toamnă și o iarnă fierbinte. Cred că SNB va ridica cât de curând peg-ul pentru a descuraja orice tendințe bull pe francul elvețian. Dar sunt simple speculații. Viitorul o va spune.

Intrări Recente

-

netinvestmen's Blog

Un blog de netinvestmen în General- 4 intrări

- 0 comentarii

- 29250 citiri

Bazele fundamentale ale comerțului pe piața de capital

Latest entry by netinvestmen,

Cu toții am auzit de termenul "rezistență", dar ce semnificație are el? Așa dar, în contextul mecanicii de piață, resistența într-un up-trend apare cînd cineva vinde hîrtiile în același timp cînd este dorit un up-rally. În acest caz oferta flotantă încă nu a fost lichidată, iar piața eventual, nu contribuie la atingerea noilor maxime. Iată de ce oferta (rezistența) trebuie mai întîi să fie lichidată pentru ca trendul să fie un bullrally semnificativ.

Doar începe mișcarea în sus, restul traderilor, ca turma de oi, tind să se alăture trendului. Acest fenomen unii îl mai numesc instinctul de turmă (sau comportamentul maselor). Ca indivizi, suntem liberi în acțiune, gîndire, dar trebuie să recunoaștem, că la apriția unui pericol sau a unor posibilități ispititoare, cum n-ar fi de pardoxal, dar purtările fiecăruia pot fi predictibile. Anume aceastene cunoștințe a purtării maselor, ajută traderul profesionist, să găsească momentele cele mai oportune de maximilizare a profitului.

Pînă cînd nu se va schimba psihologia purtării oamenilor, efectul instinctului de turmă va persista pe piețele financiare. Traderii profesioniști sunt prădătorii, iar cei neinformați- prada din turmă. Întotdeauna trebuie să ținem minte de asta.

Sunt doar două motive fundamentale de ce piața de capital își schimbă direcția:

1. "Mulțimea" e în panică, după o cădere semnificativă pe piața (în special după apariția noutăților proaste), și deobicei, urmînd instinctul, vinde. Ca un trader ce cunoaște psihologia mulțimii, întrebați-vă: "S-au pregătit oare traderii profesioniști (smartmoney) și marketmakerii pentru a acumula vînzările din panică la aceste nivele de preț?" Dacă răspunsu e da, atunci acesta este un semnal al puterii pieții (strongmarket).

2. După ridicușuri semnificative "mulțimea" se neliniștete că pierdere mișcarea și se afundă în ea, deobicei la noutăți bune. Aici sunt localizați și traderii care sunt poziționați long și doresc profituri mai mari. Aici trebuie să ne întrebăm: "Își vînd activele traderii profesioniști pe fonu acestor cumpărări?". Dacă da, atunci aceasta e un semnal serios de slăbiciune.

Nu însemnă oare asta, că suntem sortiți întotdeauna să jucăm după muzica pusă de alții? Păi... Și da, și nu.

Un trader profesionist se marginalizează de mulțime, și devine prădător, nu pradă. El înțelege și depistează pricinele care mișcă piețele, și nu se lasă manipulat de noutățile bune sau rele, indicatori, indicii, sfaturi, sugestiile brokerilor etc. Cînd piața "zdruncină" (shake-out) la noutăți rele, el cumpără. Cînd mulțimea cumpără, iar noutățile sunt bune, el caută oportunități de vînzare.

Noi ne aflăm într-o lume de afaceri unde sunt concentrați cei mai iscusiți oameni ai gîndirii. Tot ce ne trebuie nouă este să ne alăturăm lor. Comerțul alături de Deținătorii Puternici cere abilități de a recunoaște la timp, este oare piața într-o disbalanță și este ea interesantă pentru profesioniști acum?

Dacă putem să cumpărăm cînd cumpără professioniștii (acumulare sau reacumulare), și să vindem cînd vînd profesioniștii (distribuire sau redistribuire), și nu ne abatem de sistemul de trading, doar așa putem să devenim un Trader de succes.

Intrări Recente

-

forexistatzepuita's Blog

Un blog de forexistatzepuita în General- 1 intrare

- 46 comentarii

- 285217 citiri

Tzepele Forex

As dori sa povestesc experienta mea de viata cu aceste afaceri de pe internet pentru cei care nu au experienta in tranzactii bursiere, cum sunt eu . Am vazut o reclama pe Facebook, care s-a dovedit a fi mincinoasa, cum ca Investesti 1000$ la Ufxmarkets si castigi 5000$ in cateva saptamani. Cum eram dornica sa-mi completez salariul mic am zis hai sa incerc, cu toate ca nu aveam experienta si cunostinte in domeniul bursier. M-am inscris pe net la ei pe cont demo si m-au contactat ca sa ma convinga sa-mi fac cont la ei , dar cont real. Ma rog, am stat cateva zile pe cont demo tot studiind ce este ufxmarkets si ce se intampla cand tranzactionez, si mi-am dat seama ca nu ma voi pricepe niciodata sa tranzactionez pe piata bursiera singura, ca trebuie ani de studii economice pentru a intelege mecanismul burselor. Am zis totusi, auzind de la ei ca ma va ghida un director de cont, sa incep sa investesc si le-am transferat 1000$. Mi-au cerut o gramada de acte si le-am dat si pe mama si pe tata, numai sa incep sa vad cum se fac bani pe bursa. Dupa ce le-au intrat banii in cont, m-au cautat brokerii Alin Varlan, Marian Stancu si Alina Radu care mi-au spus sa incep tranzactiile dupa cum imi vor spune ei. Adica, m-a suna brokerul Alin Varlan si imi spunea " Am un pont, tranzactionati asa..." . A doua zi constat ca o tranzactie a fost pe plus si alta pe minus, dar eram pe pierdere. Cand il intreb ce se intampla imi zice ca asa-i la bursa, nimic nu e sigur si nu imi garanteaza nimic. Imi spune ca sa continui totusi si sa sper ca imi va da ponturi astfel incat profitul sa fie mai mare decat pierderea. Dupa cateva zile, in care am facut doar ce mi-a spus brokerul , am pierdut toti banii. Interesant este in timpul ultimei tranzactie, in timp ce mai aveam in jur de 100$ in cont imi tot aparea mesajul " Atentie risc, alimentati de pe card cu 50 $ ", adica TZEAPA, de fapt asta-i tactica lor, sa storca fraierii de bani. Dupa socul suferit pe acest tip de afacere il sun pe broker si il intreb ce s-a intamplat, ca doar am facut ce mi-a spus el. Initial mi-a raspuns ca nu mi-a dat el sfatul sa investesc tranzactia facut, dar cand i-am zis ca ii dovedesc cu mesajul primit pe e-mail a intors-o ca la Ploiesti. Ca asa-i la bursa, nimic nu e sigur si el nu-mi garanteaza nimic, dar sa continui sa investesc si sa am incredere in el si ca voi castiga candva ceva. Apropo, deoarece am un sot mai destept si sanatos decat mine, mi-am retras o parte din bani inainte inainte sa pierd tot. Acum astept acei bani, si daca nu imi dau banii retrasi ii voi da in judecata, alta solutie nu exista. DECI, CONCLUZIE : Mi-au luat banii cu tranzactii proaste spuse chiar de ei si s-ar putea ca nici sa nu-mi dea banii pe care i-am retras. Adica TZEAPA cu acest tip de afacere pe net. Mi-am scris propria experienta pentru cei care nu au studii economice bursiere, cred ca vor intelege ceva din materialele furnizate de ei, si se gandesc ca vor castiga ceva.

-

Free Leaders

- 1 intrare

- 1 comentariu

- 21942 citiri

Hello World... I am writing in English because I believe that every successful trader should Learn this Language to Better understand the Macro Factors that influence the Markets.

Latest entry by Tiberiu,

Cu "Grexit" sau fara exitul Greciei, Euro se va aprecia in dauna Dolarului si a Yen-ului Japonez in momentul stabilizarii / clarificarii situatiei la nivel politic si economic.

Cred ca se profita la maxim de aceste zvonuri pe pietele financiare.

Investitorii profesionisti stiu sa-si maximizeze profiturile.

Si daca ne gandim la nivel macroeconomic deprecierea monedei Euro de la inceputul lunii Mai nu a facut decat sa incurajeze exporturile din zona Euro intarind astfel economiile tarilor membre.

Totusi paradoxul se inregistreaza in cresterea economica negativa care genereaza premizele unei recesiuni in Italia, Marea Britanie, Spania, Portugalia, cresterea economica 0 din Franta... numai Germania a inregistrat o crestere a PIB-ului in ultima luna.

Din punct de vedere tehnic Euro va inregistra o reversie rapida a trendului negativ minor curand dupa cum arata si analizele mele tehnice.

Desi sentimentul este inca "Risk Adversion" se pare ca s-a rupt corelatia dinte Aur si Eur/Usd in ultimele zile. (un semn de reversal), o corelatie neobisnuita pana in august 2011, deoarecere in mod normal exista o corelare negativa intre Aur si S&P 500 / Eur/Usd, intrucat Aurul a fost dintotdeauna considerat un Safe-Heaven.

Cu respect,

Tiberiu

-

Latest entry by scorpion1333,

Dupa NFP, treburile sunt in general clare.Dolarul incepe sa reintre pe trendul ascendent,avand la baza date care arata o revenire a economiei Americane.Rata somajului a scazut de la 8,5 la 8,3 , fiind peste asteptari.Locurile de munca au fost si ele peste asteptari, cu peste 243 de mii de joburi create in luna ianuarie.

In acest timp, Euro da semne ca nu poate trece de 1.32, prag pe care a incercat de mai multe ori in aceasta saptamana sa-l sparga.Rumorile inca persista in zona Euro, unul dintre motive fiind neintelegerea dintre Grecia si UE privind o noua transa de bani.

Lira tatoneaza 1.58, nereusind inca sa recunoasca acest prag ca suport.

Revenind la indexul dolarului, dupa ce saptamana trecuta 79 a jucat rolul de rezistenta, lucrurile s-au schimbat dupa NFP, acest prag devenind suport.

Principalul scop a dolarului pentru acesta saptamana este de a recupera din pierderile fata de yen,77 fiind urmatoarea tinta.

Intrări Recente

-

Latest entry by george1979,

Inspir adanc... aerul nu imi ajunge iar tigara abia am stins-o... sunt nelinistit si simt goluri in stomac. Ma uit la platforma de tranzactionare ultima pozitie am inchis-o acum o ora si ceva, pe minus evident si ceva imi spune ca voi fi mult mai calm, golurile vor disparea si voi face si ceva bani daca intru acum in piata. Incerc sa imi stapanesc impulsul de deschide ordinul pentru ca si precedenta tranzactie a fost luata tot asa. "Este nevoie de DISCIPLINA" imi spun "Da, dar poti avea noroc de data asta" imi sopteste cineva din creier.

Pretul incepe sa se miste haotic si golul din stomac incepe sa se mareasca"Ce naiba se intampla?" Deschid calendarul economic.....NFP-ul... firar... am uitat de el!!! Incep sa rasfoiesc repede cateva forum-uri pentru a vedea ce se poate intampla daca datele ies in plus sau minus. OK. Daca datele ies peste asteptari pretul sparge rezistenta de la 1.3200 daca nu revine pe trend descendent cu mentiunea ca poate vizita in prima faza limita range-ului astfel incat nu se recomanda tranzactionarea imediat dupa afisarea datelor.

Incepe o lunga si chinuitoare asteptare de 2 minute....243 k actual, asteptarile fiind de 150 k. "Floare la ureche" imi spun! "hai sa asteptam sa se retraga" volatilitatea atinge cote maxime si pretul se retrage pana la un anumit punct dupa care merge iar in sus. Deschid ordinul si apas buy.... golul din stomac dispare subit si ma trezesc ca dupa un somn "De ce am facut asta?" Dupa 10 secunde cotatia trece de punctul invincibil si avanseaza serios in jos . "Eh trebuie sa se intoarca doar datele au iesit grozav de bine". Ma ridic de la platforma si revin dupa 10 minute... -68 de pips... ma apuca durerea de cap. Inchid pozitia la -50.

Morala: Nu trata golurile de stomac cu dureri de cap!!!

Intrări Recente

-

Latest entry by Criodi,

Pe vamist am fost mai intai un incepator. In timp insa am invatat multe. Pe parcursul maturizarii mele ca trader am participat pe forum cu material educational si postari despre elemente ce eu le-am considerat ca fiind foarte importante oricarui trader. Aceasta lista contine cele mai bune postari personale - postari in care discut despre money management, analiza fundamentala, psihologie si multe altele.

Aspecte Generale

Despre leverage, margin si margin call

Topicul asta este exact despre leverage, margin si margin call. Surprinzator nu?

Un fel de critica asupra celor care au impresia ca poti reusi in meseria asta depunand un minim de efort.

O analogie militara.

Esti un trader bun sau doar ai noroc? (topic extra long)

Intelegi de ce faci profit? Poti sa imi explici in termeni rationali motivele din spatele fiecarei tranzactii pe care ai pus-o? Daca nu, dar totusi ai profit, probabil ca doar ai avut noroc.

De ce strategiile publice in general nu merg

Orice oportunitatie de profit va fi folosita atat de mult incat oportunitatea se va inchide in cele din urma. Strategiile si informatia publica nu aduc profit - ele sunt deja in pret. Cu cat o strategie anume va fi mai folosita cu atat mai putin profitabila va deveni.

Un exercitiu de imaginatie prin care incerc sa explic conceptele ce stau la baza functionarii unei banci centrale.

O parafrazare/parodie a efectului Dunning-Kruger combinat cu celebra reclama iForex in care vanzatoarea Maria aducea acasa mii de euro cu forex. Suferiti de acest efect daca va bagati in trading fara sa stiti ce faceti.

Psihologie si Money Management

Trading-ul: Joc al probabilitatilor

Un topic despre probabilitati in Forex si despre cum ne poate ajuta intelegerea acestor probabilitati sa fim niste traderi mai buni.

Trading-ul: Sistemul de valori si credinte

Despre sistemul de valori si credinte al fiecarui individ si despre manifestarea acestuia in trading.

Trading-ul: Emotiile, Money Managementul

Un topic despre emotiile prin care trece un trader in timpul unui trade si despre cum un money management bun ne poate ajuta sa ramanem obiectivi.

Risk Management (must read)

In primul rand iti asumi un risc. Daca vrei sa ai succes in meseria asta trebuie sa sti sa iti administrezi riscurile. Speranta de profit vine la urma.

Analiza Fundamentala

Cum se formeaza si cum se misca pretul? O intrebare simpla pe care multi nici macar nu si-o pun. Si apoi au pretentia de a specula miscari viitoare ale pretului...

Elemente fundamentale in evolutia pretului (must read)

Despre mecanica din spatele pretului (mai mult decat in postul de mai sus), despre cum actioneaza traderii in piata si despre impactul stirilor asupra pretului.

Despre cerere si oferta si formarea pretului

Ca si in cele doua link-uri de mai sus si aici discut despre formarea pretului. O fac insa din perspectiva cererii si ofertei si iau pas cu pas fiecare moment prin care pretul trece atunci cand se formeaza.

De ce este NFP-ul un anunt atat de important?

Non Farm Payrolls-ul american este probabil cel mai important anunt economic si reactiile la numerele afisate sunt adesea violente. E obligatoriu deci pentru orice trader sa intelega de ce acest numar economic este atat de important.

Analiza Tehnica

Trading pe nivele de suport si rezistenta

Strategia personala de trade. Am evoluat de cand am deschis topicul si strategia personala a devenit din ce in ce mai discretionara, dar conceptele ce stau la baza fiecarei tranzactii pe care o pun au ramas cam aceleasi.

Evaluarea unei strategii de tranzactionare (must read)

Concepte si elemente cheie ce trebuiesc luate in calcul atunci cand evaluam performanta strategiilor noastre.

Cat timp trebuie testata o strategie?

De cate tranzactii este nevoie pentru a putea spune ca rezultatele strategiei sunt relevante?

Resurse MT4 si Chrome (o da, stiu si ceva programare,

)

)Fiti mereu la curent cu ce se mai intampla pe vamist. Acest indicator va afiseaza ultimele postari de pe vamist direct in platforma mt4.

Extensie Vamist pentru Google Chrome

Aceasta extensie va afiseaza ultimele 10 postari vamist si va alerteaza subtil cand apar postari noi pe care nu le-ati citit.

Un indicator care va afiseaza cele mai importante sesiuni si nivelele orizontale de open/close.

Un indicator care va alerteaza cand pretul atinge anumite nivele de pret, cand pretul atinge sau crosses an ema, cand se deschide o bara noua pe chart si cand pretul atinge un anumit moment dat in timp.

Indicator loturi tranzactionabile

Un indicator care va afiseaza in coltul din stanga sus cate loturi trebuie sa jucati pentru a risca o anumita suma in $ pe o anumita distanta in pips.

Cum sa fi un forumist de calitate

-

Latest entry by sec,

-

Latest entry by DiMaKe,

Actual: 1.5755

Am asistat la o apreciere a lirei sterline fata de dolarul american pe fondul zvonurilor ca fondul european de salvare se va cvadruplica de la 440 mld euro in prezent. In momentul de fata Gbp/Usd nu da semne de a se deprecia, insa 1.5800 va avea un cuvant de spus in ceea ce priveste urmatoarea directie.

Daca pozitiile short luate nu au fost inchise as recomanda plasadea unui ordin timid in 1.5800 in ideea unei viitoare deprecieri.

Intrări Recente

-

Trading-ul ca o profesie

Un blog de funkagenda în General- 1 intrare

- 4 comentarii

- 12874 citiri

Etapele si disciplina necesara in trading.

Latest entry by funkagenda,

ESTIMATED READING TIME: 18 MINUTES, 55 SECONDS. CONTAINS 3802 WORDS

[ Am reusit sa transform neintentionat acest thread de pe forum, in ceva ce aduce cu un jurnal. Si daca asa s-a intamplat, acum din inertie am tendinta sa contiuni in acelasi mod, numai ca am decis sa o fac aici si nu pe forum pentru a nu ingreuna threadul cu reflectii inutile !

Pe forum voi incerca sa sintetizez cat mai mult chestiunile, si aici cu siguranta voi revenii atunci cand simt nevoia sa intru in detalii. Fiind la inceput de drum cred ca pentru moment forumul imi poate fii de folos, insa cu siguranta nu trebuie sa fie singura sursa de informatii si in nici un caz nu are rost sa il transform in locul pentru divagatii, iata de ce am simtit nevoia deschiderii unui blog.

Un fel de disclaimer :

Acesta se vrea a fii pentru inceput mai mult un fel de jurnal, care tine evidenta evolutiei personale, si nu vrea nicidecum sa formeze pareri sau credinte pe baza celor scrise de mine, pentru ca ATENTIE si eu sunt la inceput, deci nu pot spune lucrurilor pe nume pentru ca nu am inca o autoritate in acest domeniu, si dupa cum am vazut, autoritatea in acest sector se poate obtine doar atunci cand esti sustinut de rezultate constante si demonstrabile. Si chiar atunci cand aceste rezultate vor aparea ramane faptul ca in acest domeniu nu este de ajuns sa asculti ce spun altii pentru a avea succes, trebuie sa treci prin filtrul ratiuni proprii, si sa reusesti sa aplici cunostintele in felul in care sa obtii TU rezultate. La subiectul asta o sa revin la timpul potrivit, ideea e ca nimeni nu trebuie sa ia nimic de bun pana nu verifica, si distinctia intre oameni o face de multe ori tocmai aceasta verificare a veridicitatii informatiilor.

Acum eu personal spun ca pshihologia are un rol important in formarea unui trader discretionar dar fiecare trebuie sa verifice bine aceasta afirmatie inainte, ori sa ma creada fara sa verifice si sa treaca mai departe. ]

" Am inceput sa vad lumea reala in termeni forex, si fara sa vreau am inceput sa transpun invataturi din viata de zii cu zii in forex. Consider ca acesta, este un semn ca sunt cu adevarat interesat si deci poate am o afinitate, pe care ar fii pacat sa nu o dezvolt. Nestiind ce ma asteapta pe viitor consider ca ceea ce mi se intampla este un lucru bun, si am de gand sa nu renunt.

Tocmai de aceea am ales sa iau o pauza de cateva zile, am acumulat prea multe informati in prea scurt timp, si am nevoie sa le diger, si sa le asez mai bine cap la cap. Ceea ce urmeaza sunt ganduri proprii care m-am hotarat sa le fac publice pentru a ma face cunoscut mai bine, pentru a avea posibilitatea de a imi urmarii evolutia dar si pentru a putea ajuta pe altii care se afla la inceput de drum. Daca cineva e curios despre legatura dintre forex si noroc, acesta e modul meu complicat de a explica lucrurile. Cred ca totul se poate explica mult mai pe scurt, si daca cineva considera ca intelege conceptul de noroc, sau noroc ca functie de timp si ce prejudecati pot aparea, nu trebuie sa isi piarda timpul sa vada cum ma chinuie talentul pe mine la ora asta

Daca cineva e incepator sau daca faceti parte din cei care sunteti obisnuiti cu 'nuvelele' mele si aveti timp de pierdut, apasati pe offtopic.

OfftopicAm inceput cu multe intrebari si astazi dupa exact o luna ma gasesc in pozitia de a avea mult mai multe intrebari decat la inceput.Nu aceleasi, altele, de alta natura, la fel de importante, cu care am sa revin, si nu sunt prezente aici.

Intre timp eu sper ca toti cei care citesc ce scriu eu aici si sunt in postura de incepatori sa inteleaga, ca daca si lor le se intampla aceasi chestie este un proces normal, si daca are loc e un semn bun.

Pentru mine este un semn bun faptul ca realizez pe zi ce trece ca subiectul este foarte complex, si necesita multe cunostiinte pentru a putea fi aprofundat la un nivel care sa permita castiguri constante, si pentru mine asta este dovada ca este un lucru real, realizabil, si ca nu se trateaza de iluzii.

Poate uni cred ca ma pierd in amanunte, dar eu dau o mare importanta detaliilor, si iau in considerare si un alt lucru important : timpul. Ce legatura are acesta ? O legatura directa, cu norocul pe care multi nu o fac, sau prefera sa creada ca nu exista, si ca timpul si norocul sunt separate. Or fii la alte nivele dar in ceea ce il priveste pe om ele sunt direct legate.

Pentru mine e normal ca lucrurile care iti ofera un castig mare sa fie greu de realizat, este o chestie de bun simt, si daca lumea din ziua de azi a ajuns in stadiul in care este, a facut-o datorita lipsei acestui bun simt, si implicit a ideiilor care nasc din aceasta lipsa.

Multi viseaza sa se imbogateasca peste noapte, pentru a putea ascunde de fapt in spatele banilor persoana.

Intr-o societate inundata de imagine, multi cred ca ei sunt imaginea pe care o prezinta, si cum bine se stie si este promovat ca banii, iti pot oferii orice, in special o imagine, majoritatea viseaza la multi bani, repede, acum si aici, pentru a se afisa in societate si a-si satisface vanitatea sau pentru a se izola de aceasta si a putea consuma orice dupa bunul lor plac.

Lacomia lucreaza intr-un fel foarte ascuns, mai ales in mintea egoistilor, atat in cea a celui deja bogat care vrea tot timpul mai mult, cat si in mintea celui sarac care daca este egoist, va devenii in principiu invidios. Aceasta lacomie are puterea de a pune un val pe ochii celui care o nutreste si 'fermenteaza' pana cand il face sa se minta singur, ca lucrurile bune pot fii obtinute si rapid, si nimeni nu ne interzice noua asta, nimeni nu poate sa ne ia ce ni se 'cuvine', ignorand de fapt un lucru esential, pe care tot din lispa de educatie au evitat sa il studieze pe parcurs, si anume ca in lume exsita totusi un echilibru, si nu tot timpul, echilibrul este vizibil cu ochiul liber datorita efectului TIMP, si ca asa cum zic englezii 'there is no such thing as a free lunch' !!

Acest lucru o zice fiecare popor pe limba lui, dar de fapt omul nostru nu crede ca nimic nu este gratis sau ca lucrurile bune si de durata se castiga in timp. Cand vine vorba de el oricine crede ca ii se cuvine mai mult doar pentru ca nu este in stare sa gandeasca obiectiv. Intradevar este greu sa fii obiectiv cand este vorba despre tine, dar un lucru de bun simt ar trebuii sa il stim toti. Cred ca ar fii bine sa stim cu cine ne luptam atunci cand incercam sa castigam bani in forex ca incepatori, ATENTIE, ca incepatori !

Ca incepatori, trebuie sa stim ca nu avem acelesi arme pe care le au altii, si fara sa lungesc discutia pentru a explica de ce, (pentru ca acest subiect merita tratat separat), eu zic ca nu ne luptam nici cu alti traderi nici nu brokerul nici cu piata cum multi poate a-ti incercat sa intuiti.

Ne luptam de fapt cu iluzii personale si in principiu toate pornesc de le un concept abstract numit noroc, si aici consider ca e necesar sa intru in detalii despre acest subiect vast pe care o sa il tratez doar superficial. Credeti-ma pe cuvant, e vorba doar de noroc ! Si de asteparile pe care le avem vizavi de aceasta ! Si de ce e norocul mai tare decat noi ?

Si exact aici e necesar o sa o iau pe aratura pentru a ma intoarce pe drumul nostru :

Avem trei entitati diferite se numesc om, timp si noroc. Acum, omul ar vrea sa fie prieten cu ceilalti doi, dar ei nici nu stiu de existenta acestuia, deci cum sa fie ei prieteni daca pt. ei nici nu exista ? Ei doi se cunosc de mult, si se respecta, insa omul, noul venit, ar vrea sa fie si el prieten cu ei, ar vrea sa fie si el egal, si de aici se ajunge la iluzia ca norocul sau timpul pot fii de partea ta, adica prietenii tai. In realitate acestia nici nu stiu ca existi si noi avem iluzia ca ei pot fii de partea noastra.

Cand tu speri de fapt sa ai o succesiune de castiguri in forex sau sa castigi la lotto, sau sa iti pice ceva din cer, tu de fapt nu speri decat sa fii prieten cu norocul, dar cati stiu de fapt ca norocul nu este prieten cu tine si nici nu vrea, si nici timpul nu vrea pentru ca el guverneaza peste multe lucruri inclusiv peste noroc, uite deci ca nici ei doi de fapt nu sunt tovarasi egali si tot timpul face ce vrea, si daca timpul nu vrea, tu nu dai ochii cu norocul. Tu esti prieten cu norocul numai daca vrea si timpul, si doar daca el ii da voie norocului acesta va fii prietenul tau. Deci daca vrei ca norocul sa fie de partea ta ar fii bine sa stii ca exista si altcineva mai smecher decat norocul. Poti sa ai noroc daca esti la locul potrivit, dar nu e de ajuns, trebuie sa fii si la timpul potrivit, altfel ai sta intr-un loc si ai astepta norocul

De aia se zice sa nu stai ca iti sta norocul, tu trebuie sa iti cauti norocul dar sa fii constient si ca de fapt timpul este cel ce determina norocul. Daca joci o saptamana la lotto e posibil sa dea norocul peste tine, dar e umpic mai probabil ca norocul sa dea peste tine daca joci o viata intreaga, si asta e usor demonstrabil. Ai de fiecare data aceleasi sanse, asta sigur, dar statistic ai mai multe sanse pe durata vietii sa castigi daca incerci de mai multe ori, deci daca esti insistent in timp. Timpul te controleaza si atat timp cat te gandesti la noroc trebuie sa te gadnesti la el ca functie de timp. Degeaba a miliarda combinatie este castigatoare caci asta ar insemna sa poti sa traiesti mii de ani, deci cu norocul te poti intalnii in cele din urma, .. da doar daca iti permite timpul.

De aia se zice sa nu stai ca iti sta norocul, tu trebuie sa iti cauti norocul dar sa fii constient si ca de fapt timpul este cel ce determina norocul. Daca joci o saptamana la lotto e posibil sa dea norocul peste tine, dar e umpic mai probabil ca norocul sa dea peste tine daca joci o viata intreaga, si asta e usor demonstrabil. Ai de fiecare data aceleasi sanse, asta sigur, dar statistic ai mai multe sanse pe durata vietii sa castigi daca incerci de mai multe ori, deci daca esti insistent in timp. Timpul te controleaza si atat timp cat te gandesti la noroc trebuie sa te gadnesti la el ca functie de timp. Degeaba a miliarda combinatie este castigatoare caci asta ar insemna sa poti sa traiesti mii de ani, deci cu norocul te poti intalnii in cele din urma, .. da doar daca iti permite timpul.Timpul are totusi o caracteristica cruda si eficienta dar si una inselatoare care iti poate oferii o oportunitate de a putea castiga, si o poti face doar daca iti fortezi intalnirea cu norocul. Atunci cand iti asumi un risc, cauti norocul dar ce risti ? .... Pariezi de fapt timp contra timp.

Sa ma explic mai bine : atunci cand tu cauti sa obtii timp, nu ai alta moneda pentru acesta decat timp. Asta pentru ca timpul este el smecher, si nu accepta altceva in schimbul lui, e mai tare ca oamenii si in nici un caz nu accepta lucruri omenesti cum ar fii banii.

OfftopicDaca ar accepta bani, multi ar putea cumpara timp. Un avantaj impotriva timpului il ofera banii dar nu in modul direct despre care vreau sa vorbesc, si asa sunt offtopic in offtopic, si poate pe forumul gresit Am scuza ca incerc sa explic si altora ceea ce am inteles eu intr-o luna de cand ma intersez despre forex in general, si poate le poate fii de folos, pentru ca ideea este una simpla si eu la randul meu cand am citit-o am trecut-o pur si simplu cu vederea, cum probabil o sa o faca si alti incepatori. Ma simt dator sa o spun, in speranta ca altii vor economisii timp, timp pe care eu l-am cheltuit in a invata un singur lucru luna asta. Acel lucru este legat de raportul intre risc si rasplata care tine cont de dimensiunea timp.

Am scuza ca incerc sa explic si altora ceea ce am inteles eu intr-o luna de cand ma intersez despre forex in general, si poate le poate fii de folos, pentru ca ideea este una simpla si eu la randul meu cand am citit-o am trecut-o pur si simplu cu vederea, cum probabil o sa o faca si alti incepatori. Ma simt dator sa o spun, in speranta ca altii vor economisii timp, timp pe care eu l-am cheltuit in a invata un singur lucru luna asta. Acel lucru este legat de raportul intre risc si rasplata care tine cont de dimensiunea timp.Cand spuneam mai sus de timp si ca acesta ne guverneaza si ca el poate fii indoit, vroiam sa zic ca timpul nu acepta bani sau altceva omenesc ci doar alt timp, pentru ca el nu stie de altceva, si noi atunci cand riscam, nu riscam bani, de fapt riscam tot timp pentru a putea castiga timp. Banii ii vrem pentru a duce un trai mai bun si involuntar pentru a traii mai mult. Vrem deci sa castigam timp, si putem in schimb sa pierdem, viata, libertatea, banii, familie, etc. si ce sunt toate acestea daca nu timp ? Viata este dependanta de timp, libertatea pierduta e implicit timp pierdut, banii sunt la fel relatie de timp (time is money) si totul de fapt este castigat in TIMP. Riscul e masurat in timp, si rasplata la fel. Cu cat risti mai mult cu atat poti sa castigi mai mult, dar sa nu crezi ca asta iti va merge la infinit pentru ca timpul are grije sa echilibreze lucrurile, si sa iti ia inapoi tot !

Iata deci de ce cred eu ca multi oameni nu inteleg ca atunci cand noi vrem mult acum, pentru a pastra echilibrul esential al lucrurilor, nu puteam avea un castig mare fara un risc aferent. Ori crezi in noroc ori pentru mine e simplu, in forex ca si in viata, daca vrei sa ai mult trebuie sa risti mult, asta pentru ca, castigurile sunt fara doar si poate corelate cu riscul.

Ai doua variante : unu, ori se risti mult ca sa obtii mult, dar pe termen lung norocul isi arata puterea, ori doi, risti putin si speri tot la putin si bunul simt te face sa te multumesti cu atat fara sa lasi lacomia sa intervina in gandire.

Mentalitatea de fricos in jocurile ce tin de probabilitate este una sanatoasa si culmea este ca pentru a obtine in timp performanta e bine sa tinzi mai mult spre constanta decat spre performanta. De aici si alta vorba 'no pain, no gain'.

Fiecare alege sa creada care variata vrea, unu crede ca fara a te chinui cat de cat este imposibil sa obtii ceva bun, iar altul cred ce este chestiune de 'destin' sau de 'noroc' si nimeni nu iti poate zice tie cum sa iti conduci viata.

Fiecare risca cat vrea, dar ar trebuii sa tina cont de vorbele batranilor caci ei au experianta timpuli, si fiecare popor isi are proverbele lui, eu fiind un pasionat de limbii si de culturi am observat ca toate aceste proverbe si invataturi se aseamana uimitor si depasesc tot timpul praguri de cultura sau limba, dar abolut toate si in nicuna dintre invataturile unei culturi nu se subestimeaza puterea 'timpului' a 'destinului' sau a 'norocului'.

Cred ca toti ar trebuii sa recunoastem neputinta omului fata de anumite, elemente care ne depasesc, si aici sa nu intelegeti vreunul ca eu spun ca oamenii sunt supusi unui destin, caci nu cred in asa ceva, dar una e sa nu fii supus si alta e sa il provoci, in sensul de a il sfida. Timpul guverneaza oamenii si aceasta este moneda cu care ei platesc. Asa cum in orice joc de noroc, esti supus infrangeri datorita subcapitalizarii, asa si oamenii sunt supusi sa piarda in lupta cu norocul si moneda in care ei platesc este timpul.

Daca oamenii ar avea mai mult timp, cu siguranta odata si odata ar reusii sa fac tot ce vor si sa castige tot ce vor, asta probabilistic vorbind, dar in realitate toti avem un timp limitat si in jocul cu soarta nu avem cum sa castigam mult fara a risca mult.

Iata care cred eu ca este problema si de ce multi ajung aici cu mentalitatea gresita, uni vin cu sperante sau pretentii prea mari, si continua asa, si pe parcurs au doar doua alternative pentru a nu isi face rau singuri : ori renunta la preconceptii daunatoare cum ar fii 'ca mie mi se cuvine mult' pentru ca sunt destept si merit, sau poate o sa am noroc ca ghinioane am tot avut, ori reununta la tot convinsi ca 'nu e pentru ei'.

Cei ce intampina problema in felul asta cu siguranta vor fii cei carora le va trebuii mai mult timp pentru a avea succes, si nu pentru ca au obiective prea mari ci pentru ca se mint singuri.

Cei ce vor infrunta piata cu respectul pe care il merita orice lucru al carui rezultat depind de actiunea timpului, si isi aduce aminte ca omul este un sclav al timpului, aceluia ii va trebuii mai putin timp pentru a reusii, si nu pentru ca are obiective mici ci dimpotriva, pentru ca sunt prea mari, (doar obiectivele reale, realizabile sunt obiective mari restul sunt vise) si el este constient ca lucrurile bune vin in timp.

Fiecare e dator sa aiba curajul de a incerca sa afle ce fel de om este, iti place sa crezi in noroc si sa te lasi purtat de valurile lui, ori iti place sa controlezi lucrurile, astfel incat daca te intalnesti cu norocul bine, daca nu iarasi bine, pentru ca tu nu te bazezi pe el pentru a castiga.

De accea sunt acum in cautarea unei strategii care sa poata exclude cat mai mult factorul noroc din componenta ei, si chiar daca sunt departe deocamdata, eu sunt sigur ca se poate. O asemenea strategie presupune lucruri concrete si nu reflectiile nefolositoare pe care le insir eu aici, si imi e imposibil sa nu fac legatura intre discutiile anterioare despre tehnica HFT si modul in care ea reuseste sa profite. Legatura pe care o vad este ca acestea incearca sa bata factorul noroc, prin legatura care am facut-o mai sus, si anume corelatia noroc-timp. Omul a gasit o modalitate de a 'bate' norocul, cu risc minim dar 'inseland', la capitolul timp, ...altfel nu se poate face, altfel nu bati corelatia noroc-timp, decat 'inseland' !!

Sunt ferm convins pe factorul timp este singur responsabil care poate influenta orice previziune. Orice previzine fie ea meteo, sau forex, este destinata sa devina din ce in ce mai neclara/difuza/imprecisa/etc. odata cu trecerea timpului. Si acum dupa tot ce am aflat, cat sa cred eu in acuratetea unor analize ce tin asa putin cont de factorul timp ? Noi nu avem timpi corecti si am vrea sa stim de ce nu putem prezice viitorul mai precis ? Nu e usor sa o faci cu date complete despre volum si timp, dar cu datele incomplete ? Asa ca am pus stop deocamdata la indicatori bazati pe candele japoneze, venite la mana a 3-a, cu lag-urile aferente, si cu o platforma comerciala care ne da iluzia ca detinem controlul daca avem sub ochi un grafic voit complicat pentru a ne distrage de la o problema cu DOAR DOUA SOLUTII : SUS-JOS !

Daca ar fii sa facem un concurs meteorologic, sau care sa anticipeze cursul economiei in general, care predictii credeti ca ar fii cele mai precise ? Cele pe termen lung sau cele pe termen scurt ? Cele pentru o ora sau o zii, sau cele pentru anotimp sau an ?

Omul nu poate bata norocul, decat pe termen scurt, si nu va reusi cat de curand sa bata timpul pe termen lung, pentru ca informatiile continute in timpul ce urmeaza sa se scurga sunt prea vaste pentru a fii vreodata cuprinse de om sau de vreo inventie de a lui.

Acestea fiind spuse, dupa scurta mea experienta, imi iau singur responsabilitatea sa recomand incepatorilor pe cat posibil sa abordeze in felul asta problema si nu vor avea decat de castigat, nu isi vor face iluzii, nu vor pierde banii, si poate cel mai important, vor rezista pana intr-un punct unde din inertie si din orgoliu vor fii nevoiti sa continue. Nu omor visele nimanui, si daca exista cineva cu vise de imbogatire cred ca ar face mai bine sa isi incerce norocul in alta parte pentru ca aici daca nu vrea sa faca sacrificii are sanse egale sau mai putine, decat in alte parti. In afara de lucrurile elementare despre trading si analiza, aceste este cel mai important lucru pe care l-am invatat.

Si daca pentru unii pare simplu si totul se putea reduce la fraza, forexul nu e joc de noroc, si credeti ca propozitia are sens numai pentru incepatori, ganditi-va si la faptul ca si voi atunci cand puneti un order, o faceti in functie de asteptari si de probabilitati, in speranta ca norocul va fii de partea voastra, pentru ca daca ar fi vorba de o stiinta exacta, nu ar mai fi loc pt. asemenea cuvant (noroc).

Ganditi-va daca vreodata v-ati lasat dusi de val, si a-ti sperat ca 'isi va revenii', si credeti-ma pe cuvant ca pentru mine nu e un lucru de nimic ca am depasit acea faza fara a trece prin ea. Eu nu ma refer aici la noroc in sensul ca cineva s-ar baza pe noroc chior, si sunt constient ca ne jucam cu procente mici, de aici si faimoasele reguli, cu riscul de 2% care limiteaza riscul in timp, si cine urmeaza acesti pasi deja castiga pentru ca nu pierde. Eu ma refer la noroc, atunci cand vorbim de interpretarile estimative pe care incercam sa le facem, si ca in spatele lor sunt de fapt ascunse procente mult mai mari de improbabilitati decat am vrea noi sa credem. Cred ca tocamai datorita acestor necunoscute, unele forme de analiza sunt bazate mai mult pe noroc decat pe un sistem riguros, si drept dovada zicem ca s-a schimbat piata atunci cand zarurile nu mai cad in favoarea noastra.

Singurul motiv pentru care nu sunt pe real e simplu, as pierde banii pentru ca nu stiu inca sa castig si in plus nu sunt sigur daca metodele conventionale iti dau un real avantaj in lupta cu imprevizibilul. Un prim pas pt. mine a fost verificarea personala ca forex-ul nu e simplu si nu e vb. de noroc, un al doilea, consta in gasirea tehnicii potrivite si de actualitate, d.p.d.v. al rezultatelor demonstrabile, si tocmai aici m-am impotmolit deocamdata.

Tot in ceea ce ma priveste, in afar de studiul notiunilor de baza ale tradingului si de citit carti, articole, forumuri, si de exersat pe demo, intre timp am acumulat o groaza de informatie care este in 'pending' si pe care pe viitor va trebui sa o structurez astfel incat sa o invat sistematic altfel, risc sa ajung in situatia in care sunt acum, unde am mai multe intrebari ca la inceput. Am decis sa iau aceasta scurta pauza pentru a putea revenii cu o mentalitate noua, mai proaspata si daca e posibil si mai de larga vizune, si sper sa pot continua in acelasi ritm, caci am o serie noua de intrebari, la care sper sa gasesc raspunsul si daca voi avea probleme o sa vi le propun si voua caci pana acum acest forum mi-a fost de ajutor ! ...numai bine

"

" -

Latest entry by mihai666,

Long Term

BUY

GBP/JPY, Target 138

EUR/CAD, target 1.42

(www.ro-forex.eu)

Performanta Contului Meu

-

Latest entry by naibody,

* TF WEEKLEY

o TREND ASCENDENT CU 3 VALURI, posibil a semnala sfarsitul trenului;* TF DAILY

o TREND DESCENDENT+ 2 rezistente importante in apropiere (R1 0.9216)+ sta la FIBO Extension 100 (FE100 = 0.9160)* TF 1H

o TREND ASCENDENT+ DIVERGENTA BEARISH MACD;+ esuat la FE=R=0.9190;+ sta pe suport dinamic si static;+ posibil DOUBLE TOP* TF 30min

o TREND ASCENDENT+ sta pe suport (suport HS = 0.9190 care este o rezistenta)+ in apropiere 2 suporturi static si dinamic.Din analiza mea, o confirmare a schimbarii de trend ascendent ar fi o spargere sub 0.9144.

Am folosit indicatori IBFX - foarte utili dar si un indicator foarte interesant - PROFX.

-

TheEconomist's Forex Arbitrage Blog

Un blog de TheEconomist în General- 29 intrări

- 230 comentarii

- 1164391 citiri

Brokers, Arbitrage Strategies and impact on BcLib coding and function syntaxes

Latest entry by TheEconomist,

Finally, after some work, the blog is back in business, and with a new address : http://mqlmagazine.com

Intrări Recente

-

Nu sunt intrări blog încă

-

Nu sunt intrări blog încă

-

Nu sunt intrări blog încă

-

Nu sunt intrări blog încă

-

Nu sunt intrări blog încă

-

Nu sunt intrări blog încă

-

Sell EUR/USD, cu anticipatie?

Un blog de dirzuandreiovidiu în General- 0 intrări

- 0 comentarii

- 7255 citiri

America a fost vândută chinezilor

Nu sunt intrări blog încă