sogard

-

Număr mesaje

26 -

Înregistrat

-

Ultima Vizită

-

Zile Câștigate

2

Tip conținut

Profiluri

Forumuri

Bloguri

Postări postat de sogard

-

-

Nu urmaresc piata de capital de la noi, insa pare un pariu cu sanse slabe

-

In ultima perioada a cumparat topuri si a vandut bottomuri.

-

Acum 13 ore, Stefan a spus:

Da, se pare ca ai dreptate si nu pot fi tranzactionate direct ETF-urile ARK in Europa. Ma mai joc cu platforma lor pentru a vedea daca ma prinde indeajuns de mult cat sa fac switch.

de vina este o legislatie europeana, PRIIPS. mai multe detalii aici: https://www.justetf.com/ch/news/etf/us-domiciled-etfs.html

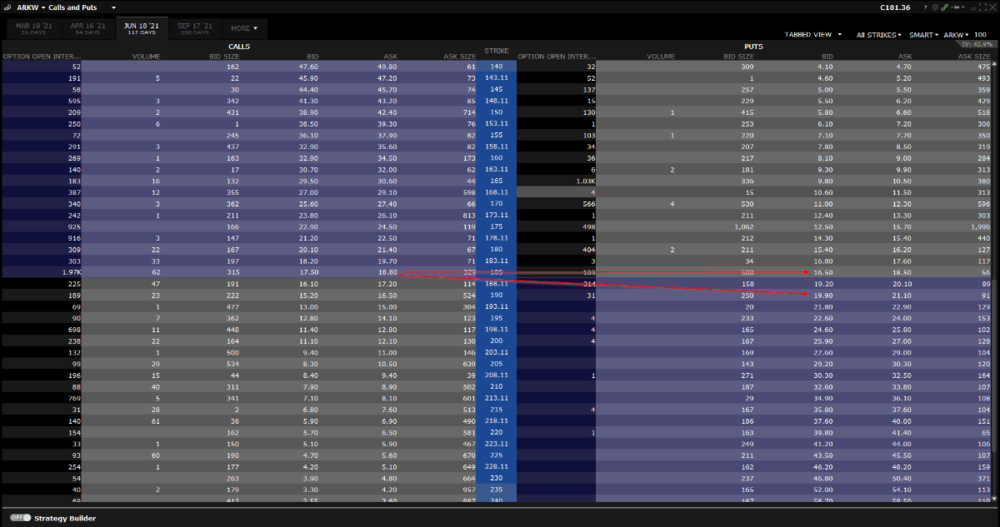

optiunile sunt insa disponibile. poti cumpara un call cu strike = pret curent si vinde un put = pret curent, ambele cu maturiate cat vrei sa tii ETF-ul. practic iti creezi o pozitie sintetica din optiuni

Later edit: m-am jucat putin in IB strategy buildervarianta 1: synthetic 185

- cumperi un call cu strike 185, maturitate 18 iunie 2021, la 18.80

- vinzi un put cu strike 185, maturitate 18 iunie 2021, la 16.50

te costa 2.3 USD sa intri in aceasta strategie care replica performanta ARKW.

Faci bani daca la maturitate pretul e peste 185 + 2.3 = 187.3. Pierderea ramane la pretul platit initial pentru intrarea in strategie daca arkw e intre 185 si 187.3. De la 185, incepi sa pierzi bani pe langa pretul platit initial

Varianta 2: risk reversal (practic tot un fel de pozitie sintetica insa esti platit sa intri in strategie deoarece vinzi un put cu strike mai mare decat strike-ul call-ului)

- cumperi un call cu strike 185, maturitate 18 iunie 2021, la 18.80

- vinzi un put cu strike 190, maturitate 18 iunie 2021, la 19.90

Primesti 1.10 USD pentru intrarea in aceasta strategie.

Daca la maturitate pretul e peste 190, incepi sa faci bani. Daca e intre 185 si 190, ramai cu cei 110 USD. Incepand cu 185, pierzi baniSper sa te ajute.

-

1

1

-

-

Gogu, asa cum cererea mea este iesita din tipar probabil asa sunt si asteptarile mele.

O sa aud lucrurile insirate de tine daca o sa le pun interbari despre sistemul lor, despre ce indicatori folosesc, ce timefreme, insa nu asta ma intereseaza pe mine.

Sunt interesat de alte aspecte, mai putin tehnice, de genul ce ocupatie au avut inainte sa se apuce de trading, cum imbina ocupatia actuala cu tradingul, cum au esuat si cum au construit iar pas cu pas, ce i-a determiant sa nu abandoneze, cate ore dedica studiului, ce materiale folosesc in studiul lor, cum au inceput si ce i-a determinat sa urmeze aceasta cale, chestii de genul asta.

Cate seminarii au loc zilnic nu stiu, cu atat mai putin daca scade procentul celor care pierd.

Stiu sigur un singur lucru, forexul este si o afacere si cu certitudine cresc conturile celor care tin seminariile respective. Ca in orice afacere exista oameni informati si oameni mai putin informati

-

Eu as vrea sesiuni Q&A cu oamenii citati in threadul "Romani de succes in forex", cu veteranii de la noi (nu trebuie sa dau nume, pot fi gasiti pe aici, pe Eurist sau pe AGF).

As vrea ca acestia sa fie respectati, numai asa ii putem face sa ne impartaseasca din experienta lor si numai asa poate creste valoarea forumului.

Si as mai vrea sa se organizeze intalniri lunare, daca nu macar trimestriale intre membrii forumului.

Acestea sunt dorintele mele, va multumesc mult.

-

Sogard, s-a intamplat ceva cu link-ul dat de tine? Vad ca nu mai merge...

Salut, nu am vazut ca s-a postat in acest thread deoarece e in josul paginii si n-am ajuns pana acolo

Cartile au fost sterse de cei de la filefront datorita incalcarii politicii de copyright.

Nu ma dau batut insa, ma gandesc sa facem un thread separat, numit "Biblioteca forex" sau ceva de genul, unde lumea sa solicite carti iar cei ce le detin sa le uplodeze pe rapidshare.de. Aici nu sunt sigur probleme iar linkurile tin destul de mult

-

Gasesti aici un thread interesant: news trading, are doar 76 de pagini si inca se mai scrie la el.

-

Am citit in numeroase articole sau carti ca traderii de succes au devenit profitabili abia dupa ce si-au consultat jurnalele in care aveau notate fiecare actiune si si-au facut o autoanaliza.

Au observat ce greseli au facut, au facut cateva ajustari si au pornit pe drumul cel bun.

Voi tineti un astfel de jurnal?

Cat de mult va ajuta?

Ce ar trebui sa contina un astfel de jurnal?

Daca se poate si un exemplu concret ar fi excelent

Multumesc

-

Black ice, inca ceva, ca sa fie mai frumos:

What did you learn from your experience in losing all your money?

I realized that no one was going to do it for me; I had to do it for myself. My broker still got a commission, but I was sitting there broke. Incidentally, although I didn't realize it then, I now fully believe that losing all of your money is one of the best things that can happen to a beginning trader.

Why?

Because it teaches you respect for the market. It is much better to learn the lesson that you can lose everything when you don't have that much money than to learn the same lesson later on.

I guess that implies you are not an advocate of paper trading for beginners.

Absolutely. I think paper trading is the worst thing you can do. If you are a beginner, trade with an amount of money that is small enough so that you can afford to lose it, but large enough so that you will feel the pain if you do. Otherwise, you're fooling yourself. I have news for you: If you go from paper trading to real trading, you're going to make totally different decisions because you're not used to being subjected to the emotional pressure. Nothing is the same. It's like shadowboxing and then getting in the ring with a professional boxer.

What do you think is going to happen? You're going to crawl up into a turtle position and get the crap beat out of you because you're not used to really getting hit. The most important thing to becoming a good trader is to trade.

How did you make the transition from failure to success?

My results were transformed when I understood that what counts isn't how often you're right, but how much you profit on your winning trades versus how much you lose on your losing trades. On average, I'm only profitable about 50 percent of the time, but I make much more when I'm right than I lose when I'm wrong.

I meant at the very beginning. How did you go from losing all your money following a broker's tip to developing your own successful methodology?

It was a slow, gradual process that took years of research and trading experience. I also readjust about every book I could find on the markets and successful individuals. Out of the hundreds of books that I read, there were probably no more than ten that had a major influence on me. However, I don't think there is any such thing as a bad book. Even if you only get one sentence out of a book, it's still worthwhile. Sometimes, one sentence can even change your life.

MARK MINERVINI - Stock Around the Clock

Stock Market Wizards - Jack Schwager

-

LazyPawn, in primul rand tin sa-ti multumesc pentru raspunsul detaliat.

Sunt perfect constient de lucrurile care le-ai prezentat pe larg, o pierdere e o pierdere, nimic nu este perfect, am vrut sa vad daca mi-am insusit corect partea cu intrarea pe piata insa mai ales aspectele discretionare.

Am recitit cele 2 parti cam de 3 ori dupa ziua de ieri si nu-mi dadeam seama daca am gresit cu ceva sau nu atunci cand am deschis primul trade, insa mai ales al doilea.

Multumesc inca o data

-

Astazi a fost o zi tare ciudata pentru GBP, una din acele zile din care as fi iesit castigat daca as fi stat pe margine si as fi privit.

Dupa semnalul de tip 3 prezentat mai sus a venit unul de tip 1 pe aceeasi pereche, foarte clar, pe care l-am luat si la care bineinteles am pierdut.

Am pierdut ambele tradeuri initiate azi, a fost o zi tare ciudata si nu-mi explic de ce. Semnalele au fost foarte clare, nu au existat stiri care dau volatilitate mare, etc.

Exista in afara de acel ceva care il capeti dupa mii de ore de stat pe tabele si sute de tradeuri initiate altceva care sa-ti spuna sa stai deoparte azi?

Oricum, sunt bucuros ca am invatat alte lectii pretioase astazi

-

Astazi in jurul orei 17.00 pe GBP / USD am depistat un semnal de tip 3, lumanarea era destul de mare, nu urmau stiri importante, asa ca m-am decis sa intru.

Dupa 40 de min insa a lovit SL setat la EMA (lumanarea verde s-a inchis la M1)

Am atasat si o poza ca sa vedeti exact despre ce este vorba.

Lazypawn, ai fi intrat la acest semnal daca erai in fata calculatorului? Daca nu, te rog, in limita timpului disponibil, sa precizezi si de ce.

Astept parerile tuturor.

Multumesc mult

-

Expert: Liviu Flesar, Founder and Senior Forex Advisor, E-Forex.ro

Topics:

- Using the mid-term analysis for intraday trading

- Filtering the false signals and identifying the good entry levels

- Identifying the exit opportunities

- Playing the breakouts

Who is Liviu Flesar?

Liviu is known by many active and novice traders worldwide since he started offering the trading advisory services like the daily trading recommendations and the weekly outlook. He started the website E-Forex.ro in 2004, he is specialized in trading currencies, technical anlysis, trading systems development but is also a daily contributor of fxstreet.com.

Session Transcript:

____________________________________________________________________

Special message from FXCM:

As the leader in FX research for Prop FX traders, FXstreet.com invites experienced and renowned FX industry professionals, traders, and leaders to speak to prop traders like yourself about market trends and how to be a more successful trader.

This information has proven extremely valuable to FXstreet's readers/clients as many feel they learn more through these Webinars open discussions than in expensive FX courses.

So for a limited time – promotion ends April 30th 2005 - FXCM is offering traders free access to FXstreet's Live Q&A transcripts for opening an account today with FXCM.

_______________________________________________________________________

Efficient techniques for the intraday trading

My name is Liviu Flesar, I started trading currencies for fun a few years ago and someday I realized that this is a little more than gambling, so I've made the first important step toward the serious trading, starting studying and applying the Technical Analysis in order to get some clues about the high probability entry and exit levels which will bring better trades, therefore, larger profits.

The funniest thing when using many technical analysis tools and complex strategies was that I found out the “ironical element” telling me something like "Man! This mess on the charts made of 5 indicators and 4 oscillators gives me much more losses than the coin toss strategy I was using in my first week of trading!" . In fact, the coin flipping strategy was more profitable than a basic MA Crossover system.

The essential thing is that a trading system has to be as simple as possible. I guess that every complicated problem has a very simple solution, so, why using complicated formulas in the circumstances where a simple trend line is efficient ?

Using the medium term analysis for day trading

Depending on people beliefs, the reasons for losing money in trading are structured on two elements: a) several reasons, probably 1 million reasons why traders fail and B) a single reason: the market's fault.

Personally, I think that only the first element is true and we have to accept that we are the only ones to blame when taking the trades in the wrong direction. Someone said that „In trading, you have only one enemy: yourself „ . Makes sense ?

So, one of that 1 million mistakes day traders do is the ignorance of the larger time frames.

Like for example, a day trader uses only the 15 min charts ignoring the larger time frame charts like 4 hours, 8 hours daily and so on. This is definitely wrong unless that trader is a convinced scalper who gets out from any trade at 3 or 5 pips profit. We want more than 3 pips, isn't it ? Or we want that ridiculous 3 pips gains but trading 100 standard lots ?

I like using the 4H hrs. charts in order to have a better view of the previous few days. The first step is identifying the support and resistance levels on that time frame of about 5 days and drawing the fibonacci retracement levels.

If possible, I also add one or few trend lines which will serve along with the support and resistance levels. After these steps are made, I can easily change the chart time frame because the lines will be there on the new intraday chart too.

Why doing all this ? Because it is good to know what is the importance of some chart area in the next few hours. For example, I chose most of my entry levels at the 50 and 38.2 Fibonacci retracement levels. Depending on my position type, these two levels may also serve as exit levels. The weekly support and resistance levels are also very important. I am sure that most of you noticed how market reverses right after entering a trade but looking at the 4H charts a bit later, that reverse looks normal. This happens all the time and the mistake is caused by the hurry, which is an opposite of discipline in trading.

It is better to think twice before entering a trade when the price is near the weekly resistance and support levels.

Other important facts when trading using small time frames charts, are the indicators and oscillators like moving averages, Stochastics, MACD and so on. I recommend taking a look at a larger time frame chart indicators and oscillators before taking a decision using the smaller time frame charts.

The larger time frame charts are very useful when used for confirmations. When looking at larger time frame charts, you can easily notice what's the current market trend and avoid entering a trade in the opposite direction, even if the small time frame technical studies point to a potential minor trend.

Filtering the false signals and identifying the good entry levels

This topic is related to the trading systems based on technical indicators. I am sure everyone used or heard about MA crossover, MACD or Stochastic systems.

All these three systems are fine and they are working great but only when the market moves on a trend. Unfortunately, 70-80% of the time, the markets are consolidating and retracing and because of the specific lag of these tools, we will get into a trade too late, when the market will be exhausted and preparing to turn around against us.

I remember how happy I was when I applied for the first time two Exponential Moving Averages, one period 5 and second period 20 on the USD/JPY 1H chart. I thought I discovered the holy grail. The crossing signals were so accurate at the first sight on the historical chart that I told myself "you're gonna become a millionaire soon!" . That happened on a Saturday afternoon, so I wasn't able to forward test that strategy until the market open, next day. I was almost unable to sleep because I was thinking about the 2000 pips profit I'll get during the next week.

Instead of 2000 pips profit I got only my Stop Loss hit for 12 times and 2 winning trades. I was so disapointed but I continued in the next two weeks with different periods for the MA, different chart time frames and the results were almost the same. The 300 pips profit I've got trading an EMA crossover signal on the 4H charts was nothing more but that thing telling me: "this strategy works only on trending markets and if I really want to continue using it, I have to find some tools to filter out the false signals".

So, when being a day trader, you will probably need something better than MA crosses, something that will be less lagging.

I use the Moving Averages only for trend confirmations now and sometimes I forget to add them on the charts and I don't even notice that. Moving Averages also work pretty fine as support/resistance levels, when price gets above or below them.

Most of the times, I use a setup of 3 elements for the entry confirmations:

1. Williams %R oscillator gives me confirmations for long positions when it closes above -35 and for the short positions when it closes below -65.

2. Moving Averages, especially T3 or T6 MA. Long positions are confirmed when price closes above MA and short positions are confirmed when price closes below MA.

I also like to use the MA levels as entries like for example: EUR/USD 1H bar closes 30 pips above 12 period MA, I look for a long position at the 12 period MA value, which will be about 30 pips below the current price.

3. Daily support and resistance levels along with the Fibonacci Studies and momentum based indicators. The Fibonacci studies are what I use for, let's say, 90% of my trades.

Along with the technical analysis tools, there are several other factors that will help us decide when to trade and when to ignore the signals of our mechanical trading systems.

The time of day is very important because every trading session has its own characteristics. There is also a frame of a few hours when the market takes its daily breath. Because of these quiet hours, most systems will give false signals during the non-volatile hours (e.g.: before the Asian session open). Therefore, it is better to ignore the mechanical signals during the quiet hours.

Another important thing is the discretion.

Most of the times, a trading system works fine only for the one who designed it. That's why the "one million traders, one million systems" sentence exists. I've met some traders that were successful without using technical or fundamental analysis. They were trusting only their opinions when looking at the charts, like the charts were saying "hey! I sit on a high area, I will consolidate during the Asian session and drop below yesterday low during the European session". I believed their success is nothing more than luck but I was wrong, because luck doesn't come back every day, for three consecutive weeks, isn't it ?

Without discretion, we won't be able to be successful.

Even the best mechanical trading system have the chances to fail on the long run, not being so profitable in the future.

I know that some people use automated trading systems with success. Personally, I wasn't able to follow a mechanical system without emotions and own opinions. Trading is a psychological game and we all know that. Where will be the fun, the happiness and even the worst feelings like frustration and greed if we will let a machine trade for us? That's not trading. It is the same like having your own teleporting device, it will be very useful when you will be in a hurry to get at the workplace but if you like driving, and you love your sport car, you will definitely prefer to use your car not the teleporting device because the simple action of pushing a button doesn't compare to your own pleasure which is driving.

We have to learn the fact that understanding ourselves is the only potential key to profitable strategies. A total approach for understanding the market requires both strategies and tactics that will help us understand ourselves and of course, understand the markets as well.

Identifying the exit opportunities

When to exit a trade? - that's a question we all ask ourselves. In fact, the exit level is more important than the entry level. We can enter a trade whenever we want, the entry it's one mouse click away from us. We don't even have to take a look at the charts or at any economic calendar before entering a trade. We can even flip a coin and decide if we will go long or short. Isn't that easy ? We have 50%-50% chances of having a winning trade. So, if the chances are 50-50, why 95% of the traders out there are losing money ? Happens to anyone to have 50 pips profit on a running position, waiting for more because all the indicators are confirming that position but the market reverses suddenly and the 50 pips are gone exiting at breakeven or even less, how about 100 pips less because there was a Non Farm Payrolls report ? That's really frustrating. Why not exiting that position at 50 pips profit ?

Well, the exit level is the hardest thing to chose. Every entry level has to be decided along with both target and stop loss levels. Without this “set of 3”, we will probably fail. Let's apply the "no target" mistake to real life. I take my clothes, my shoes and my wallet, I close the door and I get out from home, downstairs in the street. I know that I wanted to get out from home, but going where? Without a predefined localtion I'll stay there looking at the people rambling on the streets telling myself "Now what?!" and probably getting back home asking myself "where I wanted to go ?!" for several times all the way upstairs.

All I needed was a plan. Like, getting out to buy myself a beer from the corner shop. So, I get out from home, get to that shop and get back with the beer. This is discipline.

And of course beer is part of discipline because it helps making rational decisions until there's not too much of it.

We need a trading plan. We have to ask ourselves "what's the target of this trade?" and "Where do I stop if I am wrong?" before entering any trade. So we set up the limit and S/L orders. But where ?

This depends on so many things. Some traders are looking for a strict predefined target on every trade they take. Doing so, it is easier. Like for example, being satisfied with 30 pips per trade which is a great target on the long run if we are able to achieve it constantly. But what about the stops ? Well, using a fixed 30 pips target with a 90 pips stop loss won't be a good idea. The stop loss level has to be at least equal to the target level. Equal target and stop loss are ok as long as the system we use is profitable enough to have more than a 1:1 ratio of winning/losing trades.

A good strategy is using a trailing stop, even automatic or manually triggered. Locking profits and liquidating portions of our positions is a recommended thing to do.

But what about the first target level we have to set when entering a trade ? Personally, when day trading, I set an initial 70 pips target or I set an initial target based on the important zones of the chart like support/resistance, retracements. I lock profits or add more to the position until I decide to exit the trade.

For example: I move the stop at breakeven when I have 30 pips on my side, adjust that at 20 pips when there are 50 pips profit and so on. But I exit the trade when I think there will be a retracement, reversal or some major event. For confirmations of my position I analyse the larger time frame charts because they are essential, as noticed on our first topic. It is very important to adjust the stop loss order when the market is about to test some support/resistance level. Most of the times, the market is reversing after 2 or 3 failed tests of the support and resistance levels. Therefore, I use a tight stop when the market is testing the sup/res levels. Usually, the markets are testing both daily support and resistance levels during the day. It is also a good idea to draw the support and resistance levels on the charts, and when you decide to enter a trade, put the initial stop a few pips below or above the support/resistance levels. It is safer.

Playing the breakouts

I will start this topic with a continuation of the previous topic. Support and resistance levels are very useful as entry levels. Sometimes the market is reversing when testing a support/resistance level and sometimes it steps forward breaking these levels.

But when is a resistance/support level breached ? Here is where some people got it wrong. A support/resistance level is breached only when price closes above/below it. Almost every day we see sup/res tests when the market spikes through that levels and unfortunately some traders enter trades in the direction of the spikes because they think the sup/res levels were not strong enough to hold the tests and got breached. That's wrong.

Double/triple bottoms and tops are also very useful when deciding to enter a position after the support/resistance tests.

The double/triple bottom is a reversal pattern made up of two/three equal lows followed by a breakout above the resistance level. The double/triple bottom is not complete until a resistance breakout. The highest point of the formation, which would be the highest of the intermittent highs, marks resistance the major resistance.

The same applies on double/triple tops but in this case we will look for a support breakout instead resistance.

The support and resistance breakouts are good entry levels for reversal trades.

Let's take the first picture as an example. We have a support level at 1.3587 and a resistance at 1.3655. A doubled top was formed after two resistance tests. Notice that the market got above the resistance by a few points. Even so, it was not a complete breakout because the bar didn't close above. A bit later, it is time for the support level to be tested. It also got breached, therefore a good short entry level will be around the bar close, in the 1.355 area or even higher, near the 1.3487 level which is now a resistance. In both entry cases, it is a good trade for an objective of 100 points or more. But how about taking another trade, entering short in the 1.353 area where we see the 50% retracement of the previous large fall ? That's another good trade. You should all know that the market is retracing a lot during it's long-term moves and that's why fibs are working fine as entry/target levels.

If you didn't used the Fibonacci levels too much in the past, please try looking in the past on the hourly charts how great the 50% fibonacci retracement works as an entry. Apply the fibonacci studies from some daily lows to daily highs (or opposite) and you will notice that for many times, the market will reach the 50% retracement during the next day and reverse there, becoming a potential good trade.

This is only one of 1 million ways that demonstrates the efficiency of the most simple things we can use in our favour.

I've prefered to take a “fresh” day for the second picture example. This happened on Tuesday 26 of April, two days ago.

We apply the retracement study on the previous large move, more or less, being the Monday's high to low (A to B). The entry level will be the X area, 50% retracement of the AB move. But what about the target ? Well, when using this strategy I prefer to target the A or B level, depending on my position. In this case, we talk about a short position, so the objective will be the B' level, seen at 1.2955. That's what I call an accurate trade, entering short at the daily high level and exiting at the daily low. Couldn't be better than that in a single day, isn't it ? I'll be glad if you will try to find the same patterns on the charts. Works best on Eur/Usd but on other pairs as well. The last two pictures are other examples of how great Fibonacci Studies work.

Pentru a vedea pozele click aici

Sursa: www.fxstreet.com

-

Cartea despre care vorbea Fata Morgana o gasiti aici

-

Am mai gasit cateva articole de acelasi autor

Date: November 26, 2004 15:00 GMT-10 AM EST

Expert: Mihai Nichisoiu, Chief Trader of Forex Grand Capitals

Topics:

- Simple candlesticks and bars price patterns: outperforming trading setups

- Specific trading setups during the current year: short-term vs swing trading

- Risk management: still the biggest part of the trading equation

- What would you consider differently if you were to start over

Who is Mihai Nichisoiu?

Mihai Nichisoiu started his trading career as an independent player in futures currencies, and turned to spot forex in early 2002 when in the same time became one of the most popular contributors on various forex forums across the board. In December 2003 he founded Forex Grand Capitals, home for old fashioned trading where he currently features his own market positions in due real-time mirroring personal managed accounts activities. Mihai also holds special cooperation and writes on daily technical picks on several elite forex portals worldwide, including FxStreet. Great supporter of presenting his trading performance in the most fair play way, Mihai's technical picks and trading signals enclose Account Statements measuring the overall performance of his model portfolios in real-time.

Session Transcript:

FXstreet Moderator (Nov 26, 2004 10:01:29 AM)

Good morning, good afternoon, and good evening to all of you joining us today from different parts of the world. Welcome to today's Live Forex Expert Question and Answers session.

FXstreet Moderator (Nov 26, 2004 10:01:46 AM)

For those who are unfamiliar with chat sessions like this, please feel free to ask questions at anytime, though the questions will be answered at the end of the session. When you place any questions of any sort they will be posted directly to me, the moderator, before I pass them on to our guest expert. If there are questions directed to me I can reply privately to the person asking the question if that is needed.

FXstreet Moderator (Nov 26, 2004 10:02:20 AM)

A Special Note: An abbreviated summary of today's chat will be made available online some time after the conclusion of the session. For those of you that would like to receive the transcript in full please feel free to let me know at the conclusion of today's discussion by sending me your email address.

FXstreet Moderator (Nov 26, 2004 10:03:01 AM)

With all that said, it gives me a great deal of pleasure to introduce Mihai Nichisoiu, Chief Trader at Forex Grand Capitals. Mihai holds special co-operations within Forex and writes extensively on the markets. In December 2003 he founded Forex Grand Capitals, home for old fashioned trading where he currently features his own market positions in due real-time mirroring personal managed accounts activities.

Mihai (Nov 26, 2004 10:03:58 AM)

Firstly I kindly salute and thank all the participants, Henty and FxStreet for scheduling the chat. We have around one hour running so let's get to work.

Mihai (Nov 26, 2004 10:04:24 AM)

Henty is too generous in calling me an 'expert'. Take me only as a regular Joe, one main reason for which I'm staying here talking is that I've made so many loads of mistakes in the past that you won't probably have time to do in a whole life-time. There might be lessons to learn from victories too, but we people have a hidden talent to always delay or not hearing at all of subtle messages behind victories - and I don't mean about the markets work alone.

Mihai (Nov 26, 2004 10:05:10 AM)

While talking up with Henty these days I said I wouldn't want to make a whole lotta deal of my - you know - methodology of personal trading. Perhaps ironically, perhaps not - I've been making a long time journey from very basic stuff like bars and candlesticks, to trading sophisticate indicators and even into shades of mechanical trading, just to eventually getting back to the same old plain business of working with primal bars, candlesticks, and patterns.

Mihai (Nov 26, 2004 10:06:00 AM)

After few years spent in the markets I've completely given up chasing market puzzles and black suit kind opinions. This is like Hollywood a mechanism I cannot control except in a very small number of situations when it's me who chooses when, where, and with what kind of ammunition I'd be trading.

Mihai (Nov 26, 2004 10:06:42 AM)

This is also like saying my first rule for money management is just staying selective and accomodative. I always ask myself will I be the predator or will I be the hunted creature. I would never go fighting a war driving a Mini instead of a Hummer. And if the heat comes around the corner I must be ready to hit the road in a matter of seconds.

Mihai (Nov 26, 2004 10:07:44 AM)

I also certainly don't want to enter too much details about my own modus operandi since this way I have absolute freedom on re-inventing the whole deal tomorrow if I want - even if 're-inventing' nowadays means mostly just fine-tuning. Always - and I mean always, no matter the hundreds of pips you gained or lost one day, week, or year - allow yourself the possibility of re-inventing what you do the very next morning, if needed.

Mihai (Nov 26, 2004 10:08:27 AM)

Not in the last row I wanted this chat be as interactive as possible. I'm not really a fan of putting up text for ebooks or fancy presentations, I know my work extremely well and that is always brief and straight to the point.

Mihai (Nov 26, 2004 10:09:34 AM)

That's why I'll farther attempt responding to as many questions as possible. I'll anyway start telling you most of the questions I received beforehand focused on indicators and non-discretionary trading - which actually isn't really a wonder for me. They also focused way too much on technical analysis aspects - which is no wonder either. Let's start up:

____________________________________________________________________

Please note the full transcript of this session was made available to those that attended only.

____________________________________________________________________

Mihai (Nov 26, 2004 11:14:15 AM)

Well, time now to conclude the chat session, and enter the weekend. I once again thank you kindly for having been with me for this hour, with the help of Henty's maybe we will see each others again in the future. Also an occasion for me to wish you excellent winter holidays from now on.

FXstreet Moderator (Nov 26, 2004 11:15:53 AM)

We at FXstreet.com would like to thank Mihai Nichisoiu for being our guest expert, and also thank you all for participating in today's Q&A session. I hope that you found the session both interesting and educational.

FXstreet Moderator (Nov 26, 2004 11:16:07 AM)

Please feel free to post any feedback about today's session. Say what you thought was good and bad and what you think could be improved. We would very much appreciate this. I will be logged on for a while longer. The feedback will go to me only.

FXstreet Moderator (Nov 26, 2004 11:16:28 AM)

As well, if you would like to receive a transcript of today's session please feel free to send me your email address at this point.

Date: March 17, 2005 15:00 GMT

Expert: Mihai Nichisoiu, Chief Trader of Forex Grand Capitals

Topics:

- Strategic vs. predatory trading: technical tools to consider

- Trading visions vs. trading reality: which, when and how to apply

- Price pattern recognition: trading language spelled in all financial markets

Who is Mihai Nichisoiu?

Mihai Nichisoiu has started to trade in futures currencies in the late '90s, then turned to spot forex in early 2002 when he also became one of the most popular contributors on several specialized forums across the board. Currently, Mihai trades his own account as well as private and institutional money being hosted by Forex Grand Capitals - website which he founded in late 2003. Within the same professional hosting, Mihai offers a daily emailed service in which he features key market comments and real-time market standings on a timely, selective basis. Mihai is a strong advocate of old fashioned, plain business of trading - as well as one of presenting overall trading performance with a detailed track record.

Session Transcript:

This may be seen as a continuation of the open talks I had here in late November last year - and just like then I now have to stress out again I'm no educator, analyst, adviser, medium or whatever else which would assume like wearing a black fancy suit and having the latest eBook written by myself here with me to feature.

I'm only a trader and I'm just as good as my trading performance shows, nothing more, nothing less. I do not count my 'pips', I do not backtest nor simulate trading action - as I only speak in terms of genuine returns, drawdowns, account statements - and what I do in trading straight to the point.

My professional interest in this business grows progressively toward managing accounts for high-net-worth investors and hedge funds across the board looking for performance over the long-run - but I'm also gladly involved in periodic trading contests and circuits when they present themselves since I always appreciate the challenges of being assessed in real market conditions and with a real track record put on the table.

Even though I'm still up to making fine-tuning adjustements if they're needed - my trading approach hasn't changed much since November.

Versus the mundane style in trading forex nowadays which assumes acting on intraday timeframes and doing that rather around the clock (not meaning it'd be anything wrong about it, though) - I still follow a more passive decisional circuit mainly based on 'reading' the 1-day charts across the board. I do that since my mind and body don't seem to respond too well to the quick and repeated intraday - or even intrasession - market developments. Secondly - there's always the problem of having to deal with administrative costs like broker's spreads and rollover interests. You should make some simple maths, computing for instance how much you'd pay on an yearly basis for cumulative spreads assuming you'd trade 5 positions on even a major pair every day. You'd be amazed by the number of times your account should be larger at the end of the year only for covering those cumulative spreads. I made such model calculation some time ago - ironically based on a hint idea caught from...a broker advertisment.

Moreover - while acting on the 1-day charts I always have the privilege of managing risk into two separate positioning stances: the predatory one (i.e. aggressive market standings lasting for only 1-3 days, and usually based on a single-candlestick price pattern), and the strategic one (i.e. market positions initiated with very small funds at the start-up, further funds adding assumed once expected direction and momentum are confirmed, and usually based on a multi-bar price pattern).

Well - toward the strategic positions the risk profile virtually assumes way larger reward than risk - and since such positions are initially entered on an underleveraged basis and adding further funds is assumed once expected market conditions do confirm outright, realized losses once a failed start-up happens are extremely modest.

On the other hand though, - the predatory positions are usually entered with larger funds and they also usually feature a poor risk profile i.e. larger risk than reward. Predatory positions in my opinion are similar to discovering very tight trading window opportunities deriving from excellent technical setups, and exploiting them very aggressively with a 'hit & run' approach.

Problem is - always - that without discovering and effectively trading strategic positions and hence build a chance to shoot for those large rewards, I will have a growing vulnerability in taking the other sort of positions i.e. the predatory ones. For instance if I register 4-5 consecutive losses from taking predatory positions - for that's not an impossible nor rare situation - and there's no strategic trading opportunity around the corner to take benefit of, then I really do have a problem.

Zooming to the technicals, - I always search out for basic things like classic candlesticks pointing out to trend reversal or continuation, and classic multi-bar patterns. I trust my instincts a lot, and I already have a pretty reasonable visual experience to rely on at most times.

The 'bear/bull traps' remain my most favorite technical setups - for instance a textbook 'bear trap' recently occured on the USD Index (February 28th), and EUR/CHF (March 1st) on their corresponding 1-day charts which pushed for powerful bullish follow-thru in the wake of the 'spike-low' part of the pattern.

These technicals make out for very selective material - therefore I don't trade nearly as often as most traders, I guess. I don't rush out because there's no hurry to reach anywhere. Plus as everything stays with me on a full discretionary basis at times I also feel the need of cooling trading down - even though I tend to work way better under pressure rather than in relaxed conditions.

Moving to another topic, - I believe a lot of people are interested in whether to trade the reality of the charts (i.e. what's going on with the price right now) or doing it based on forecasts and various predictions. Somehow I believe this is sort of a fake dilemma.

Well - I think even those ones pretending they always trade the present are themselves in the 'forecasting' business even if they don't really feel that way - because market moves anyway, and it should do it the way you expect for earning some money out of it.

On the other hand - I personally think those ones trading based on 'forecasting' models should too have a powerful sense of what's happening right here, right now with the price. Easy say I know - because anyone of us can at times easily be trapped into choosing to act like on a couple of minor reversals on a 1-week chart, while at the same time a big 3,000-pip trend is quietly walking alongside. But, a good exercise always remain stepping off from the monitor for a couple of inches, and asking yourself about what is going there (i.e. on the longer-term chart). A few times perhaps something really big is moving just alongside - and those few times actually can make the whole big time difference between ending up an year at breakeven (or worse), and ending it up a few times better than the average industry performance benchmark. Like in any business, the best performers are those who have a very good sense of reality as well as a grand vision of the future.

Sura www.fxstreet.com

-

Astazi a fost de departe cea mai interesanta zi de cand am aflat despre forex, chiar am baut o bere la sfarsitul ei. Nu spun asta datorita castigului obtinut ci o spun datorita faptului ca am realizat in sfarsit ce inseamna emotiile si mai ales ce inseamna sa te lupti cu ele.

Pana acum nu intelegeam un lucru. Toata lumea spune sa-ti respecti strategia cu sfintenie ca sa fii profitabil pe termen lung. Disciplina este principala calitate a unui trader de succes. Si totusi, foarte multi o dau in bara. De ce? Intervin emotiile, lacomia, frica si mintea nu mai e limpede.

Nu intelegeam totusi cum e posibil, daca toti cei ce au succes spun sa fii disciplinat, sa o dai in bara.

Am inceput sa tranzactionez si eu acest sistem. Am ales 2 perechi de valute gbp/usd si usd/chf. Chiar daca au o mica legatura (mi-a spus ARagalie) am prefarat ultima pereche deoarece ofera o volatilitate destul de mare, numai buna ptr. acest sistem

La ora 18:30 (ora noastra) am depistat un semnal de tip 2 (piata era bearish, 3 lumanari s-au inchis peste EMA insa SS a ramas bearish). Cand lumanarea s-a inchis sub EMA am intrat short cu 2 loturi (am un cont demo de 1000 usd pe Oanda) respectand principiul 2% (pozitiile le-am calculat cu fisierele puse la disp. tot de LazyPawn caruia tin sa-i multumesc pe aceasta cale).

Partea interesanta incepe abia acum. La 20:30 trebuia sa plec. La acea ora insa lumanarea nu se inchisese sub M-1 ca sa pot muta SL pe breakeven ci foarte aproape. Aveam deja +42 pips pe un lot si +41 pips pe al doilea insa trebuia sa plec.

Asta insemna ca nu mai puteam ajusta SL pe breakeven la 21:00 desi eram ferm convins ca se va mai duce mult in jos. Nestiind ce sa fac am vb cu Fata Morgana care intai mi-a sugerat sa inchid si apoi sa pun un SL pe +10. Totusi, nu puteam insa sa fac asta deoarece nu respectam regulile sistemului. Am pus acel Sl pe +10 decis sa plec. Cred ca mi-a luat 3 min sa ma leg la sireturi. Eram cu ochii pe monitor, telefonul suna in disperare, intarziasem deja. Eram ferm convins ca se va mai duce in jos si voi mai face niste pipsi.

Lacomia aparuse deja. Insa am decis sa inchid ambele pozitii deoarece daca nu mai puteam controla pozitia insemna sa nu respect sistemul. Asa ca l-am inchis manual la +41 si +42 pips, total 83 pips. Pe contul meu inseamna 22$.

Ma intreb acum insa daca erau bani reali in joc cum as fi reactionat. Si ma mai inteb daca as fi avut vreun cont de 10 000 sau 50 000 de $, tot la fel as fi facut?

Nu sunt fericit ca am facut 83 de pipsi in 2 ore, sunt bucuros ca am fost disciplinat si am respectat sistemul, de aia m-am si rasplatit cu o Stella :-P

Am invatat o lectie importanta azi doar in 2 ore, cat 100 de articole citite la un loc.

Multumesc Lazypawn, Fata Morgana si Argalie pentru ajutor!

Later edit: momentul iesirii este unde se afla situat crosshair-ul in poza

-

Sincer sa fiu nu cunosc metoda LP50.

Ai aici toate detaliile despre aceasta strategie

-

eu de cateva luni bune experimentez si testez diverse strategii. Am trecut de la cele pe termen lung (1D - 4H) la cele pe termen scurt (5min-15min). Interesant e ca cele mai bine rezultate le-am avut cu cele pe termen scurt.

Una singura pentru o perioada sau mai multe deodata? Daca e ultima optiune nu e greu sa gestionezi atatea informatii?

Nu-ti impuia capul cu sistemele altora. Dezvolta-ti propriul tau sistem.

Asta si intentionez sa fac insa pana sa ajung acolo va trebui sa-mi inbogatesc considerabil bagajul de cunostinte si sa testez alte sisteme.

Am renuntat la cel prezentat in primul post si de luni voi incepe cu LP50 al lui LazyPawn. Probabil ca mai tarziu voi reveni la primul deoarece e pe tabele zilnice si semnale apar rar.

Multumesc mult pentru toate sfaturile, le voi lua in consideratie.

-

Am implinit o luna de cand am inceput sa studiez aceasta jucarie minunata.

Mi-am spus ca daca vreau sa construiesc ceva pe termen lung, care sa reziste trecerii timpului, e bine sa construiesc pe o temelie solida.

Asa ca am inceput cu babypips.com si incrediblecharts.com . In paralel citeam si articole de pe investopedia si fxstreet. Am citit si doua tutoriale (unul dinte ele e aici pe forum pe undeva) si mi-am facut conturi pe moneytec, elitetrader, MMG, Forex TSD si StrategyBuilderFX unde am citit articole din sectiunea "Beginers". De asemenea mi-am deschis un cont demo la Oanda.

De o luna incoace minim 3 ore/zi le petrec citind materiale din sursele prezentate mai sus. Si cum am citit peste tot ca e bine sa urmezi un plan de tranzactionare m-am decis asupra forex[/acronym]-school/create-system-3.html"]acestuia

Problema este ca simt ca din ecuatie lipseste ceva, ceva esential. Sistemul de mai sus ma tine foarte putin timp pe grafice, sa zicem 15 min max/zi. In 3 sapt. am prins doar un singur trade pe eur/jpy la care am facut cam 100 de pipsi.

Simt ca am neglijat partea practica, e ca si cum as fi citit un dictionar fara sa incerc sa leg propozitii sau sa fac conversatie.

Nu imi doresc sa castig mai multi pipsi/zi, nu sunt lacom. Imi doresc doar ceva mai sofisticat care sa ma atraga mai mult spre tabele, sa ma tina mai cu sufletul la gura, sa inglobeze mai multe unelte.

Nu stiu daca va mai aduceti aminte cum erati dupa o luna dupa ce ati inceput sa va jucati cu forexul insa as avea nevoie de un sfat: sa incerc un alt sistem pe o perioada mai mica ( 4h ), sa pastrez sistemul insa sa lucrez pe tabele de 4 ore, sa pastrez sistemul si sa ma joc pe tabele sau ce sa fac?

Sunt intr-un punct in care nu stiu ce directie sa apuc, ajutorul vostru mi-ar fi de folos, va multumesc anticipat.

-

Ma ofer sa ajut, programere nu stiu, pot traduce sau pot face alte chestii care le sugerati. Va stau la dispozitie in limita cunostintelor mele.

Voi incerca sa fac pe buchinistul o biblioteca virtuala cu cele mai bune materiale despre trading, spatiul este nelimitat si linkurile permanente, se speram ca nu vor fi probleme legate de copyright. Deja am uplodat 3 carti care se gasesc mai greu

Legat de partea cu semi-privat. Opinia mea e ca mai bine se ofera acces tuturor la forum insa sa fie conceputa o zona in care sa ai acces doar pe baza de invitatie, pentru discutii cu un grad mai mare de profesionalism.

-

Gasesti aici cartea lui Robert Balan, nu tebuie sa te grabesti, linkul este permanent.

Va sfatuiesc sa verificati periodic pagina buchinistului, materiale legate de forex vor fi uplodate constant.

Daca aveti vreo dorinta poate Buchinistul o va indeplini

-

Are cineva "'Trading in the Global Currency Markets" scrisa de Cornelius Luca?

Daca o aveti va rog sa o uplodati undeva sa o pot lua si eu, mi-as dori foarte mult sa o citesc.

Daca sunt doritori pentru cartea lui Robert Balan, "The Elliott Wave Principle Applied to Foreign Exchange Markets" va rog sa spuneti

-

Gasesti aici un review foarte bun al multor brokeri

-

Citind despre Elliot Wave Theory am dat peste un documentar foarte interesant, History's Hidden Engine.

M-a surprins foarte mult complexitatea lui, pana unde a indraznit sa se duca si conexiunile dintre domenii care aparent nu au nicio legatura intre ele.

O intreaga stiinta intitulata socionomics s-a dezvoltat pe baza teoriei lui Elliot.

Sunt curios ce parere au despre acest documentar cei ce au citit cartile lui Nicolas Nassim Taleb, eu nu am ajuns pana acolo insa o voi face cu siguranta.

Click aici pentru a viziona filmul

Pun mai jos un interviu cu producatorul acestui documentar, David Edmond Moore

Q: What inspired you to create a documentary on socionomics?

A: I first became interested in socionomics after reading Bob Prechter's report, “Popular Culture and The Stock Market.” It was the first time I had heard of the Wave Principle. I found it remarkable that the stock market correlates with trends in fashion, movies and music. I wasn't really a finance guy. I was just out of school, and pop culture was what interested me. What drove it home for me was that after reading the report I noticed a correlation between the crash in 1987 and a change in the music of U2 and R.E.M. Both groups went from being just rock bands to releasing two very political albums in '87. Later still, after the market recovered from the '87 crash and we extended the massive bull market through the late '80s and '90s, U2 and R.E.M. released "happy" albums. U2 went so far as to call their album Pop. You can't say it any clearer.

It was only later that I found out about the true breadth of the Wave Principle—that it doesn’t stop with the markets or even pop culture, but correlates to politics, the economy and—most exciting—biology and psychology. To think that U2 releasing an album called Pop coincident with one of the strongest, positive times in our society could have primal underpinnings was amazing to me.

The more I read Prechter's work, the more I realized that visuals would really drive socionomic ideas home. So a documentary was the obvious route.

Q: What were your greatest challenges in producing the film?

A: I could talk for a month about that topic! It was the first documentary I’ve made, so that was the first challenge. I had had some success in short fictional narratives and on-demand work, so at first I applied the same approaches to the documentary, and they didn't work. I had to wrap my head around what a documentary is. I realized that documentaries aren’t all the same, that there is a variety of approaches. The one thing I didn't want to do is make a film in the style of Michael Moore—you know, inserting my ideas and opinions into the documentary, as opposed to staying behind the scenes. Also, I knew that the ideas behind socionomics were too new and complex to explore every aspect and create a debate on film. I decided to create a piece that laid out the basic ideas with plenty of examples in a very accessible form. My hope is that this will then start the debate, and these ideas will be thoroughly examined, and socionomics can move to the next stage toward becoming a science.

Q: What intrigues you most about socionomics?

A: The most important thing is its potential to change the way we look at the world. It is obvious that initiative in creation, exploration and knowledge are driving forces of humankind. The quality ideas that Prechter and the others at the Socionomics Institute have put forth help further these pursuits. How could adding to these areas not be exciting? It's like an archeologist unearthing an ancient artifact and then hypothesizing about the role it once played in the world. I've always thought the Wave Principle and socionomics had this type of parallel, just in a more philosophical way. Also, it's cool to be part of an early science and help the ideas develop. I feel like I'm a part of something still uniquely underground and thriving, like discovering a great new movie or band before anyone else. I don't mean that in a pretentious way. I mean that whenever you discover something new that you are interested in, it reshapes the way you think, and who you are in general. Socionomics—its whole design—reshapes the way you think.

Vizionare placuta si astept parerile voastre!

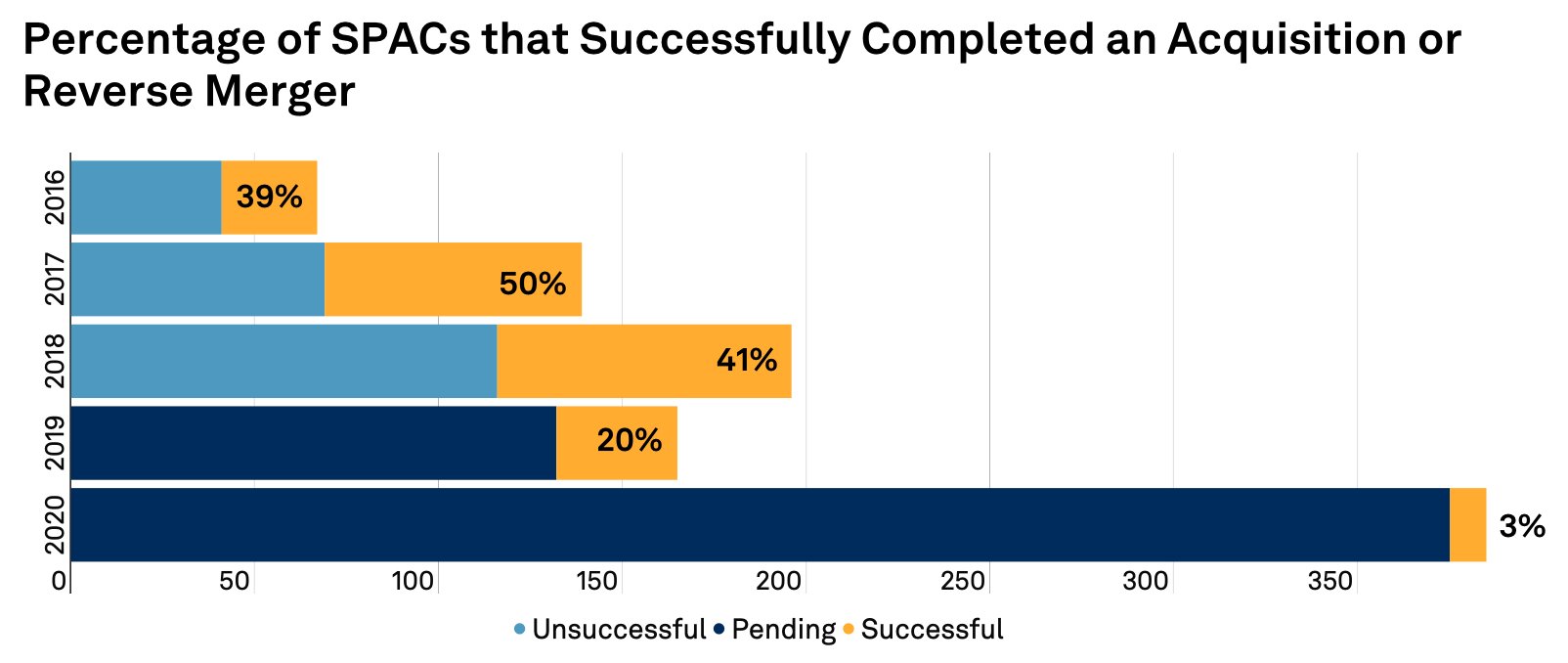

SPAC-uri in Romania

în Actiuni

Postat